Deciding between whole life vs term life insurance should rationally be driven by the numbers, especially the “buy term invest the difference” calculation below to illustrate the difference between the two types of life insurance. As much as insurance companies advertise a warm image of caring families, and while a good life insurance agent naturally should be an empathetic and caring person, the cold hard fact is that insurance companies can only protect you from financial losses.

Life insurance is and should be simple: a $1,000,000 life insurance policy pays your family $1,000,000 if you die, and nothing if you don’t die. Many people may not like the idea of paying thousands of dollars per year to something very likely to give them nothing back, but I am one of those people happy to lose 100% of what I pay a life insurance company if it means both a.) I’m still alive, and b.) I avoided losing far more in fees, commissions, and lower returns because of the math illustrated below. Last week I also posted a guideline to how much life insurance should cost at different ages, based on average US quotes I’ve seen.

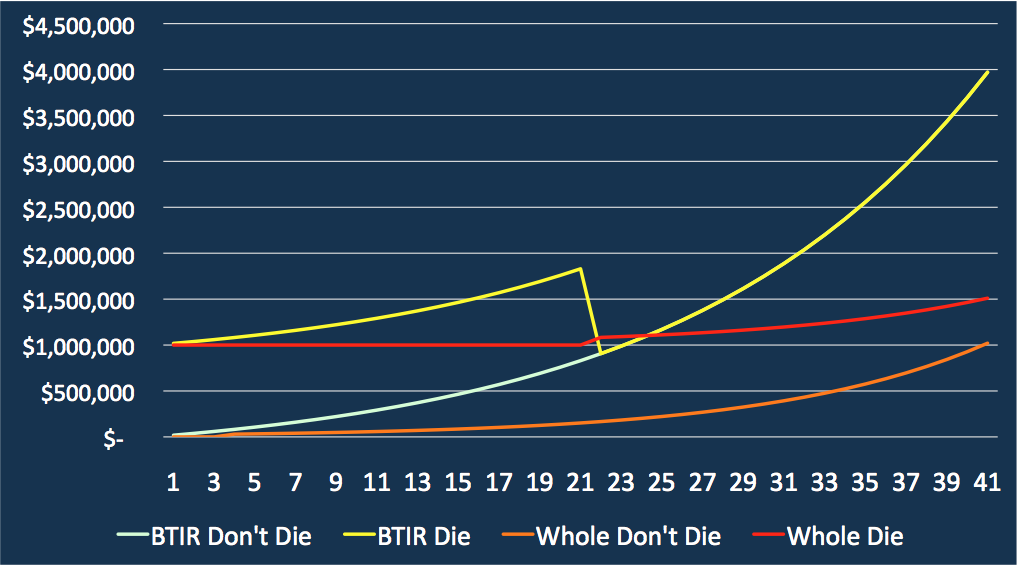

The below chart compares a $1,000,000 whole life vs term life insurance policy over a 40 year period with the following assumptions:

A. The 20-year term life insurance insurance policy premium is $1,500/year, while the whole life policy premium is $20,000/year to be fully paid up in 20 years.

B We compare one person who buys the term life policy and invests the difference with someone who buys the whole life policy, both have $20,000/year to put in life insurance and/or investments.

C. The $18,500/year difference the term life buyer is paying less than the whole life buyer is invested in a diversified portfolio of stocks and bonds earning an average annual nominal (that is, not subtracting inflation) rate of return of 7% per year, which is below what stocks and bonds have averaged over the past 40 years. The whole life policy is assumed to accrue guaranteed and death benefit values at rates similar to those I’ve seen from many insurers who sell such policies in Hong Kong based on 2017 levels of US dollar interest rates.

The below chart compares how these two policy holders’ $20,000/year would add up over the 40 year period across scenarios of how long they live.

1/ The “BTIR Don’t Die” (BTIR stands for “buy term invest the rest”) light green line is what $20,000/year for 20 years invested at 7% per year would add up to if no more contributions are made after 20 years. At 20 years, the difference invested would already have grown to almost $1,000,000, and in 20 more years, the returns alone would compound these savings to $4,000,000

2/ The “BTIR Die” scenario (yellow line) is how much the term life insurance policyholder’s family would be left with if the policy holder were to die in that year. In the first 20 years, the life insurance policy would pay out $1,000,000 on top of whatever the difference savings invested added up to. After 20 years, the term life insurance policy has expired, but the savings have already added up to the $1,000,000 needed anyways. This drop in coverage can be somewhat smoothed out with a “ladder” of coverage, say having $350,000 each in a 10 year, 20 year, and 30 year term life policy.

3/ The “Whole Don’t Die” (orange line) represents the typical cash value accrual of a whole life insurance policy, which often remains zero in earlier years, and often remains far below the amount put in until decades into the policy. In this case, the $20,000/year for 20 years only grows to $1,000,000 after about 40 years, representing an average rate of return of only around 3%. This of course assumes the policy is not cashed out or lapsed earlier, which very often happens.

4/ The “Whole Die” (red line) scenario shows what the whole life policyholder’s family would be left with if the policyholder were to die in any given year. Part of the sales pitch of the whole life policy is that it is “permanent”, meaning that the $1,000,000 will be paid out when, not if, the policyholder dies. As the below chart shows, however, this is only likely to leave the family more money than the term policyholder’s family if and only if the policyholder dies in year 21. Anytime before or anytime after, the term life insurance policyholder’s family is likely to be left with far more money, easily millions more.

I know that whole life insurance is often “sold, not bought”, and that this decision is often driven by emotion rather than numbers, but the hard math of how such a policy would leave a family poorer, often millions of dollars poorer, than the simple “buy term invest the difference” plan makes this decision too important to be left to chance or commission-based sales agents. Lottery tickets are often said to be “a tax on people who are bad at math”, and as quoted in the latest Freakonomics podcast, Americans will spend $60 billion on lottery tickets this year. Unlike million-to-one lottery tickets though, buying a $1,000,000 whole life policy will almost always leave you significantly worse off than doing the math and buying term.

I’d be happy to hear from you and discuss any questions you may have about this calculation or other financial planning topics. To be clear, I am an IFPHK CERTIFIED FINANCIAL PLANNERCM professional, and discuss insurance in the capacity of a financial planner, and am not licensed to sell nor advise on any insurance policy. I am happy to refer you to an insurance professional I know and trust, and will fully disclose my relationship with them, if you need any insurance coverage or advice specific to your situation.

One thought on “Whole life vs term life insurance: the “Buy Term Invest the Difference” calculation”

Comments are closed.