How much life insurance you need largely depends on who depends on how much of your future income, while the cost of life insurance depends more on your age and health. Fortunately, life insurance tends to be the cheapest for younger employees and entrepreneurs who have most of their potential earnings ahead of them. This post is meant to provide guideline numbers on how much a competitive annual life insurance premium should be by decade, based on the average of quotes I’ve seen on healthy US males from US life insurance companies.

Disclaimer: This post is for discussion purposes only and is not insurance advice. Neither the author nor GFM Asset Management are licensed to sell nor advise on insurance in any jurisdiction. Please contact your own insurance professional or contact us for a referral to a provider of competitive insurance quotes based on where you live.

Life insurance should more accurately be called “death insurance”, as its main benefits are to replace the money you would earn, and your dependents depend on, if and only if you die. Life insurance should be cheap, and you should be happy to lose 100% of the premiums you pay on a life insurance policy, since that means you survived and your dependents never had to be paid by an insurance company for the loss of you. Earlier I posted on why I only buy term life insurance for myself, and have so far always found “cash value” or “cash back” life insurance to be a terrible deal, often leaving policy holders paying too much and with too little actual coverage. Unfortunately, term life insurance is relatively expensive in Hong Kong, so many employees with US, UK, or EU passports are often better off getting life insurance in their home country. I second Dave Ramsey’s recommendation of Zander insurance as a great source of online term life insurance quotes.

How much life insurance would adequately replace your income? If you are 25 years old, make $100,000/year, and were to pass away the day after getting your policy, you would want to make sure the lump sum payout is enough to replace your income until your dependents would no longer need your income. If you are married with two young and healthy children, 20 years of your income, or $2,000,000, would cover your spouse and children’s needs until they hopefully become financially independent on their own. Inflation protection on life insurance policies denominated in most stable currencies (US dollars, Euros, Yen, etc.) is generally not needed, because as time passes, you would have saved more and more money to make the life cover less necessary. If you have more children or other dependents, large debts you need to pay off, or other needs, that would mean you’d need more life cover, while a single employee with no dependents usually has no need for life insurance.

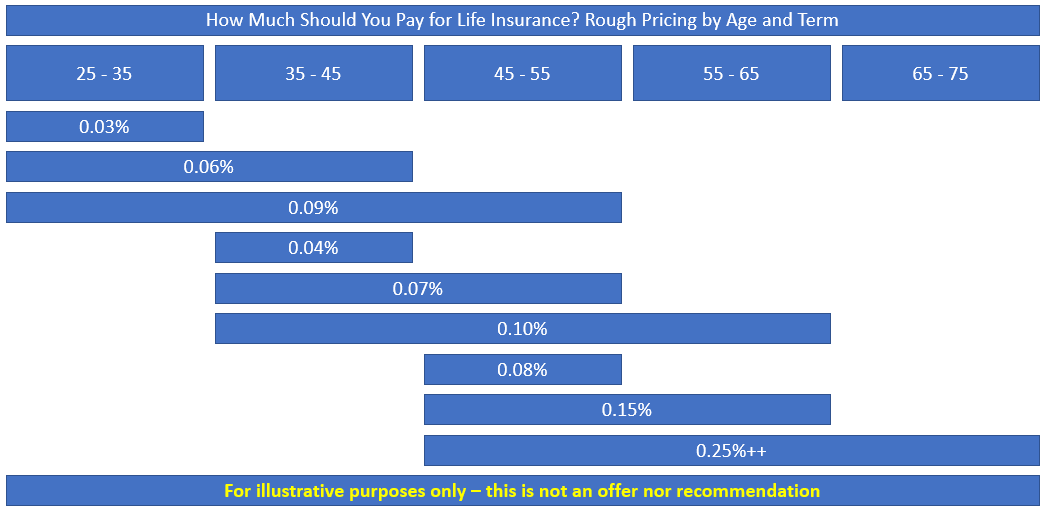

The below picture is meant to give a rough reference for how much the annual premium should be for 10, 20, and 30 year level term life insurance for a 25, 35, and 45 year old. For example, $1,000,000 of 10-year term life for a 25 year old should cost around $300/year (0.03% x $1,000,000), while a $1mio 20-year term life policy for a 45-year old would cost closer to $1,500/year, reflecting the higher chance of the 45 year old dying by age 65. I repeat that these are guideline averages based on many quotes I’ve seen for healthy males, and you will need to get your own quotes for your own situation. As some encouragement, even the relatively high $2,500/year for a $1mio 30-year level term policy shows a 45 year old can commit $75,000 to receive $1,000,000 for dying before age 75, meaning life insurance companies are more than 90% confident most 45 year olds will live well past 75. As another reference, mortality tables are published by both the Hong Kong and US governments.

Hopefully this guideline helps you take the right actions and avoid paying too much for life insurance. I look forward to hearing from you.

Kind regards,

Tariq