After changing jobs, or even getting posted on an expat assignment by the same company, employees generally have the freedom to do a 401k rollover of their retirement savings account to an IRA account at their choice of brokerage firm or mutual fund company. Doing a 401k rollover to an IRA, and consolidating all your IRA accounts at a single firm, makes tracking and accessing your retirement savings on a single statement saves time and headache, as well as opening your IRA to far more investment choices and lower fee options than most 401k plans have available. In the US, the three biggest providers of 401k rollover IRAs are Vanguard, Schwab, and Fidelity, but for American expats with non-US addresses, we have found it most efficient to do 401k rollovers to an Interactive Brokers IRA.

An American expat would need to do the following steps to complete a 401k rollover:

- Open an IRA account of the same type as the 401k account (i.e. Traditional rollover IRA for a traditional 401k, and a Roth IRA for a Roth 401k). This may require a US address.

- Ask the firm holding your IRA account if they can initiate the rollover. In the simplest case, they may be able to handle it directly from an account number, but in most cases they will require a recent 401k statement and/or a contact at your HR department or 401k provider. Fidelity has a huge advantage here in that they already administer many 401k plans, and so can easily manage a rollover into a Fidelity IRA.

It is very important that you do not let the 401k provider mail you a cheque! This not only runs the risk of delays and lost cheques, but starts a 60 day time limit in which you must complete the deposit into the new IRA account or risk having your 401k money all become a taxable distribution. Make sure you do what is called a direct rollover.

Once you have the IRA set-up and funded, be sure to check the 8 questions American expats should ask each year about your IRA accounts, one of which is whether you can save US$2,000 in taxes this year by making a deductible IRA contribution many of your stateside colleagues with 401k plans can’t take a tax deduction for.

We’d be happy to help you with a 401k rollover and IRA investment plan. Please contact us through the below form or message Tariq at +852 9476 2868.

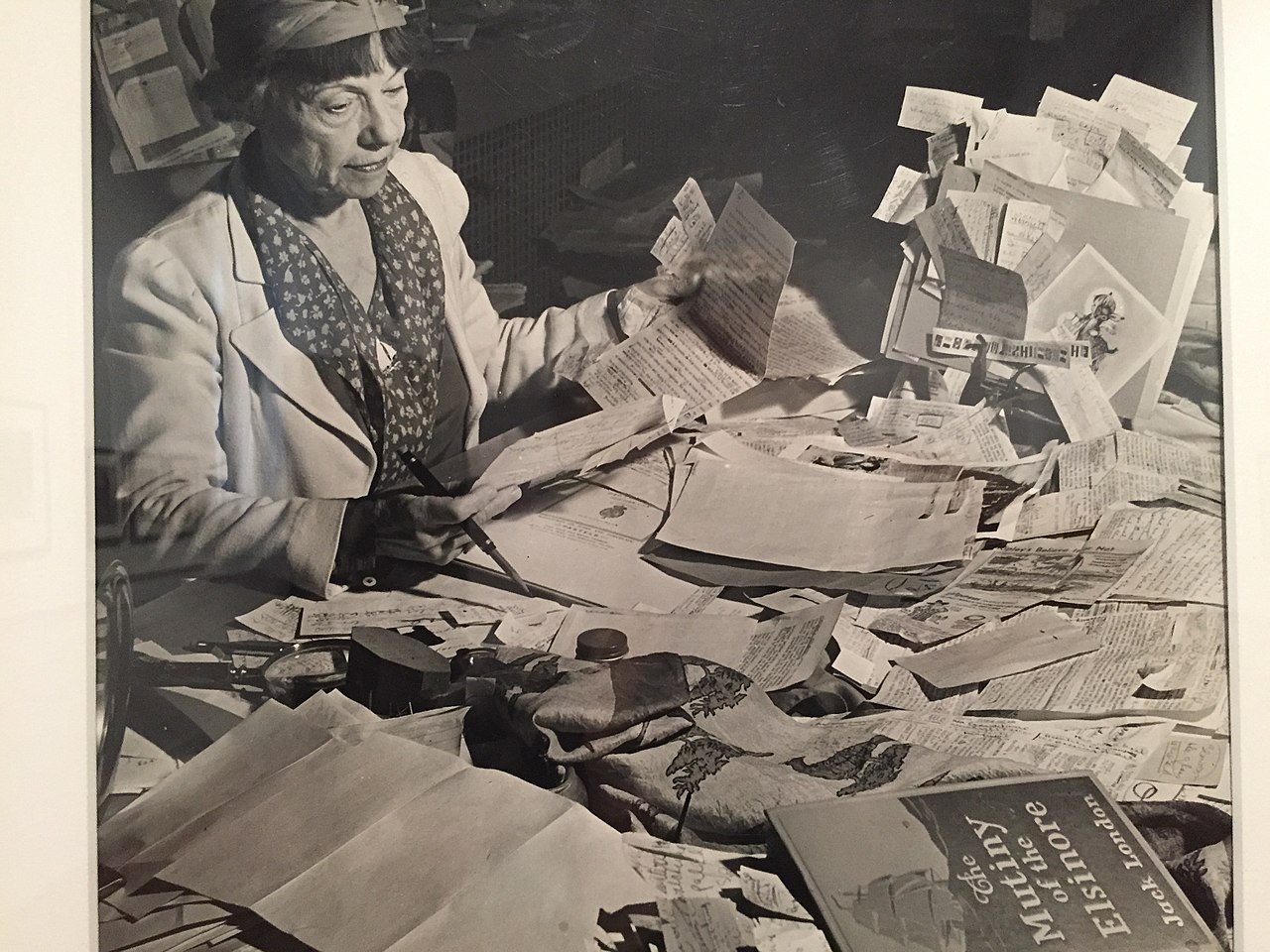

Photo credit: Wikicommons