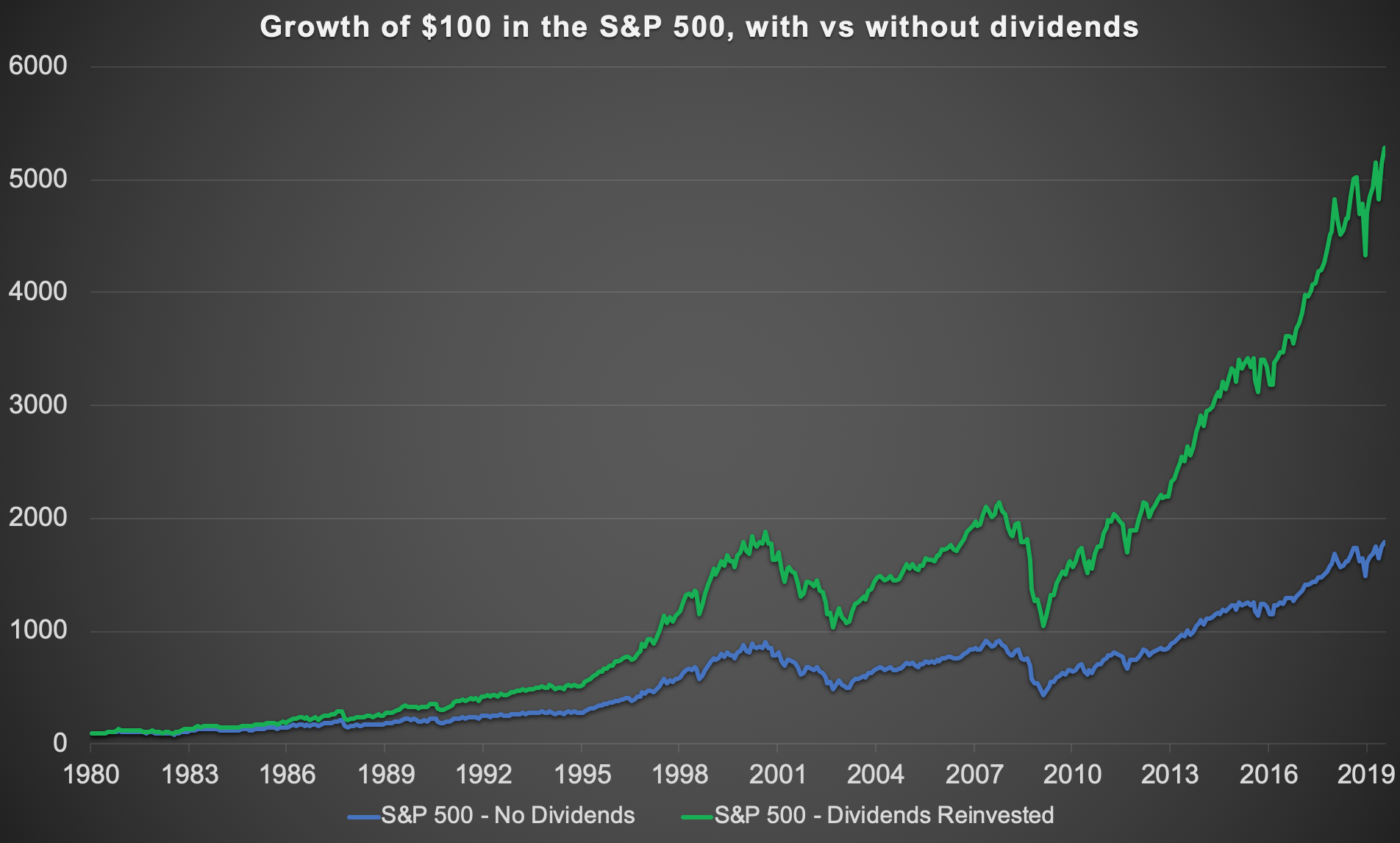

In the short term, stock returns are dominated by the ups and downs of price movements, in the long run, stock returns are dominated by dividends. A common question is “what percentage of stock returns come from dividends over the long run?”, to which I have a simple answer using the past 40 years of S&P 500 returns: 75%. Reinvested dividends over the long-term is part of the first and more stable way to make money in stocks.

Today’s chart shows the growth of an initial $100 in the S&P 500 ignoring dividends vs with dividends reinvested. The S&P 500 index has risen to 17.9x its 1980 value, but with dividends reinvested, $100,000 would have grown 52.9x to $5,285,910.

Next time you think that a 2% dividend yield is not much to get excited about, remember that unlike interest payments, dividends tend to grow over time, as the part of a company’s earnings not paid out to you as a current dividend is often reinvested to make future dividends bigger. The latter factor, as well as taxes, is one reason I don’t only buy high dividend yielding stocks, but something making up 3/4 of the S&P 500’s fabulous return over the past 40 years is a big enough factor to never ignore.

3 thoughts on “75% of S&P 500 Returns Come From Dividends: 1980-2019”

Comments are closed.