MSCI’s China A-share inclusion is one of the many themes I’ve been hearing over and over again this year. As one of the world’s largest and most respected brands in benchmarking investment portfolios, this move means that trillions of dollars of American and European retirement funds will now be required to buy more Chinese stocks, not just those listed in Hong Kong and New York, but also shares listed in Shanghai and Shenzhen that are subject to different standards of financial disclosure. I have written earlier about the difference between China’s A-share, B-share, H-share and N-share markets, why I still find most of them too expensive to get excited about, and about the separate MSCI China A-share index that has been available for years.

These changes are starting out small at only 2.5% and 5% of the index over the first few months, but these mainland shares will slowly become a more significant part of our pension portfolios. This is part of the moves that have made Greater China now represent over 50% of the total weight of emerging markets. Given the enormous size of China’s stock market though, these changes are far less significant to China than they are to foreign investors, who still account for only about 2% of the ownership of Chinese stocks.

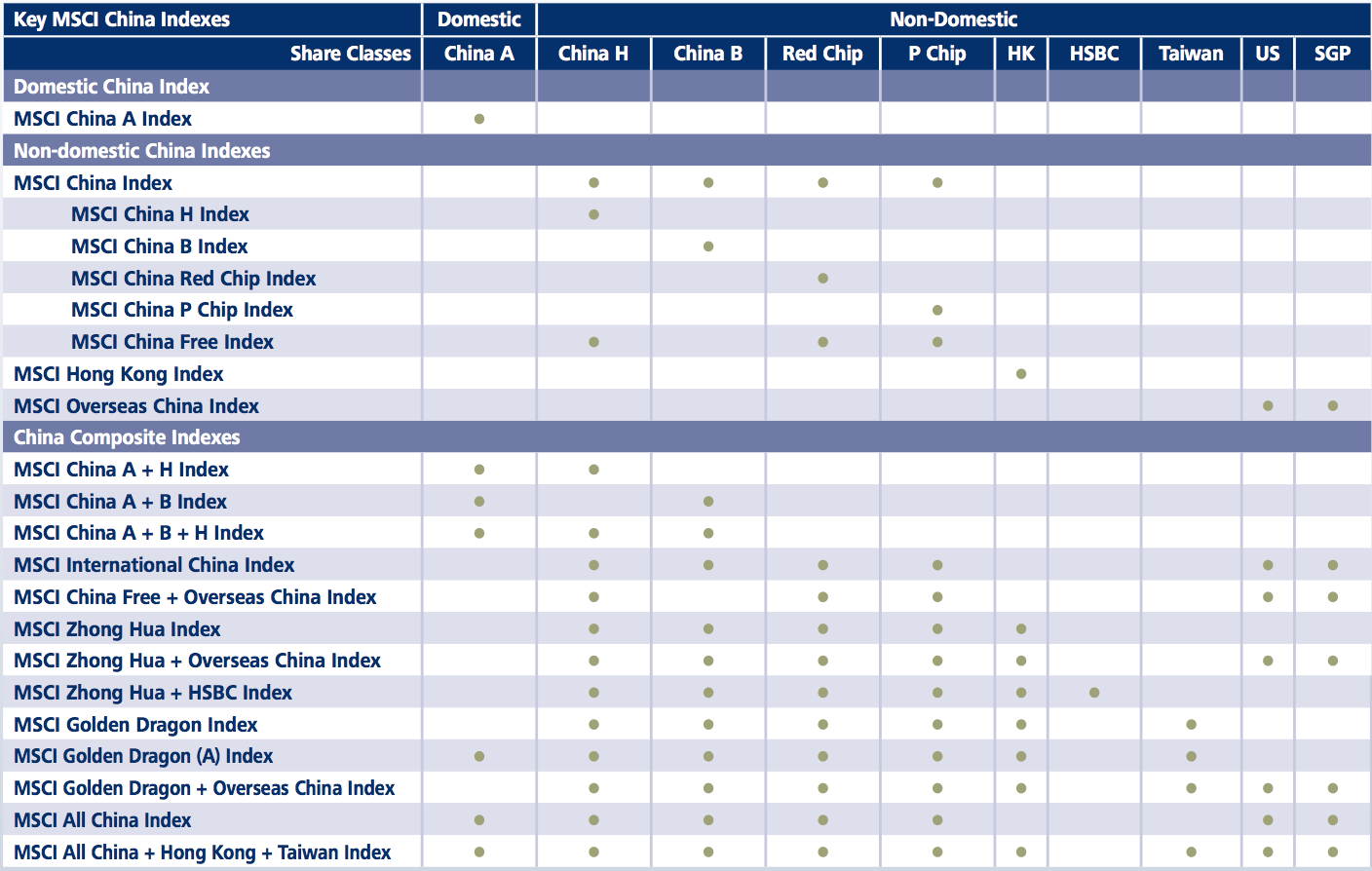

The attached table from the factsheet on MSCI China Indexes explains how all the different MSCI China indexes cover Chinese stocks listed across Mainland China, Hong Kong, Taiwan, New York and elsewhere.

One thought on “MSCI China A-Share Inclusion: Understanding Different Chinese Stock Markets”

Comments are closed.