I’ve spoken and written extensively on real estate investment trusts (REITs), but just came across these two charts comparing the performance of US equity REITs vs mortgage REITs, and the long-term total return of US REITs vs physical real estate.

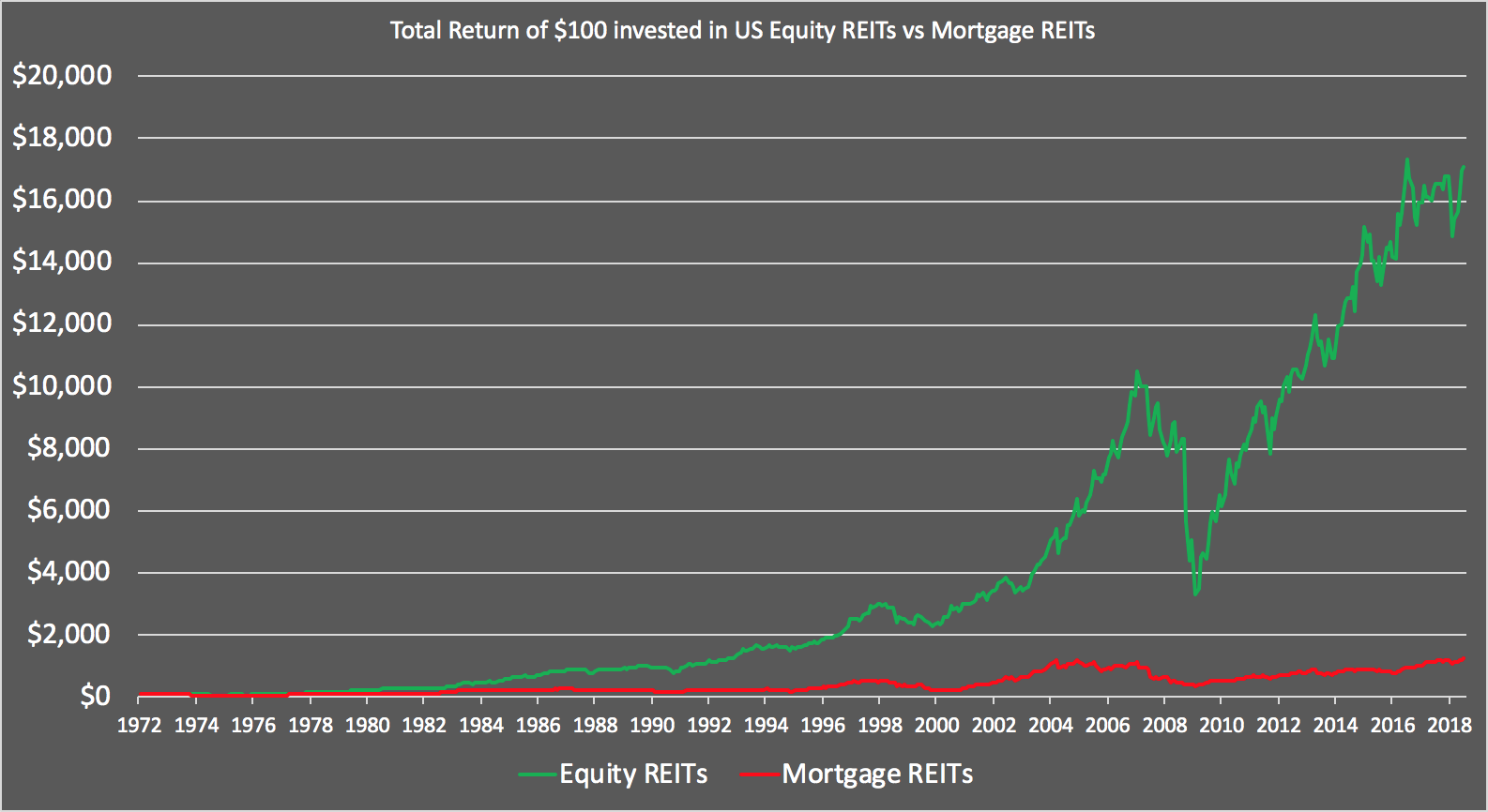

Chart #1: Performance of equity REITs vs mortgage REITs

Equity REITs own properties, and collect rental income and price appreciation from those properties, while mortgage REITs own mortgages. Equity REITs may take on debt in the form of mortgage or other financing, and mortgage REITs may take on other forms of leverage. In general, one would only expect mortgage REITs to outperform over long periods if the total return on investing in real estate averaged less than the average mortgage rate, which should only happen during prolonged periods of deflation.

The first chart shows the total return of investing $100 in 1971 in equity REITs vs mortgage REITs from 1971 to 2018. Perhaps not surprisingly, equity REITs averaged a significantly higher rate of total return (~12% vs ~7%), but I was surprised to see that mortgage REITs were often just as volatile if not more volatile than equity REITs.

Source: REIT.com

Chart #2: REITs vs physical real estate

This second chart shows the rolling 10 year returns of publicly traded REITs vs investments in physical, unlevered real estate. Perhaps surprising to most, public REITs have slightly outperformed, which might make sense when you account for professional management and economies of scale versus trying to manage your own real estate investment. The source of this chart is the Verdad blog.

How much to allocate to REITs

REITs remain a sector of the securities market I like to maintain a 10-30% allocation to (less for clients that own physical real estate, more for those who rent), mostly as an income-generating hedge against inflation and rising urban wealth. For Americans, REITs are often most tax-efficiently held in IRA or other US tax-deferred accounts.

I look forward to your questions and comments on REITs and real estate investing.

<script charset=”utf-8″ type=”text/javascript” src=”//js.hsforms.net/forms/shell.js”></script>

<script>

hbspt.forms.create({

portalId: “2644462”,

formId: “e8e82ac7-f087-40b9-98b0-539d924bac18”

});

</script>