Today’s chart is thank’s to this tweet by Mohamed El-Erian.

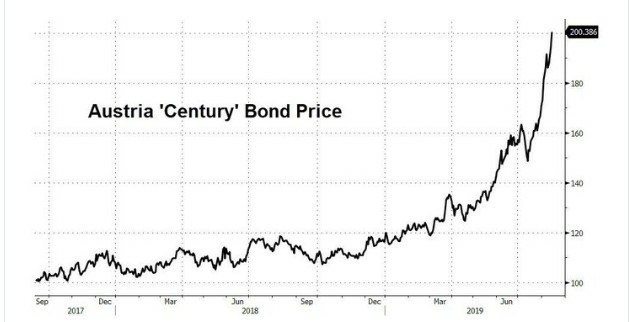

Government bonds bore most people, in part because they promise low fixed rates of return, barely above bank deposit rates, and often lock in their rates for long periods of time over which inflation could eat away the value of the principal returned at the end. Austria, on the other hand, issued 100 year bonds not long ago, and the decline of bond yields this year drove the price of these bonds up to what looks like a cherry-picked cryptocurrency chart.

It is important to understand bonds and interest rates in order to understand any other type of investment, and the significance of this level of move in long-term bond yields should not be underestimated in its impact on pensions and long-term valuations of businesses in Europe. For some of the longer term structural drivers of low Euro yields, I still recommend Joseph Stiglitz’s book “The Euro”.