US Federal taxes are complicated enough, but residents of most US states know that state and local taxes (sometimes known as “SALT”) add an additional level payments and possible complexity. While US persons (citizens and permanent residents) are generally taxed on our worldwide income and estates regardless of where we live in the world, many US state taxes are source based, residence based, or domicile based. This means more US state tax planning options for those of us who may move to many different US states over the years, or out of the United States entirely.

States with No State Income Tax

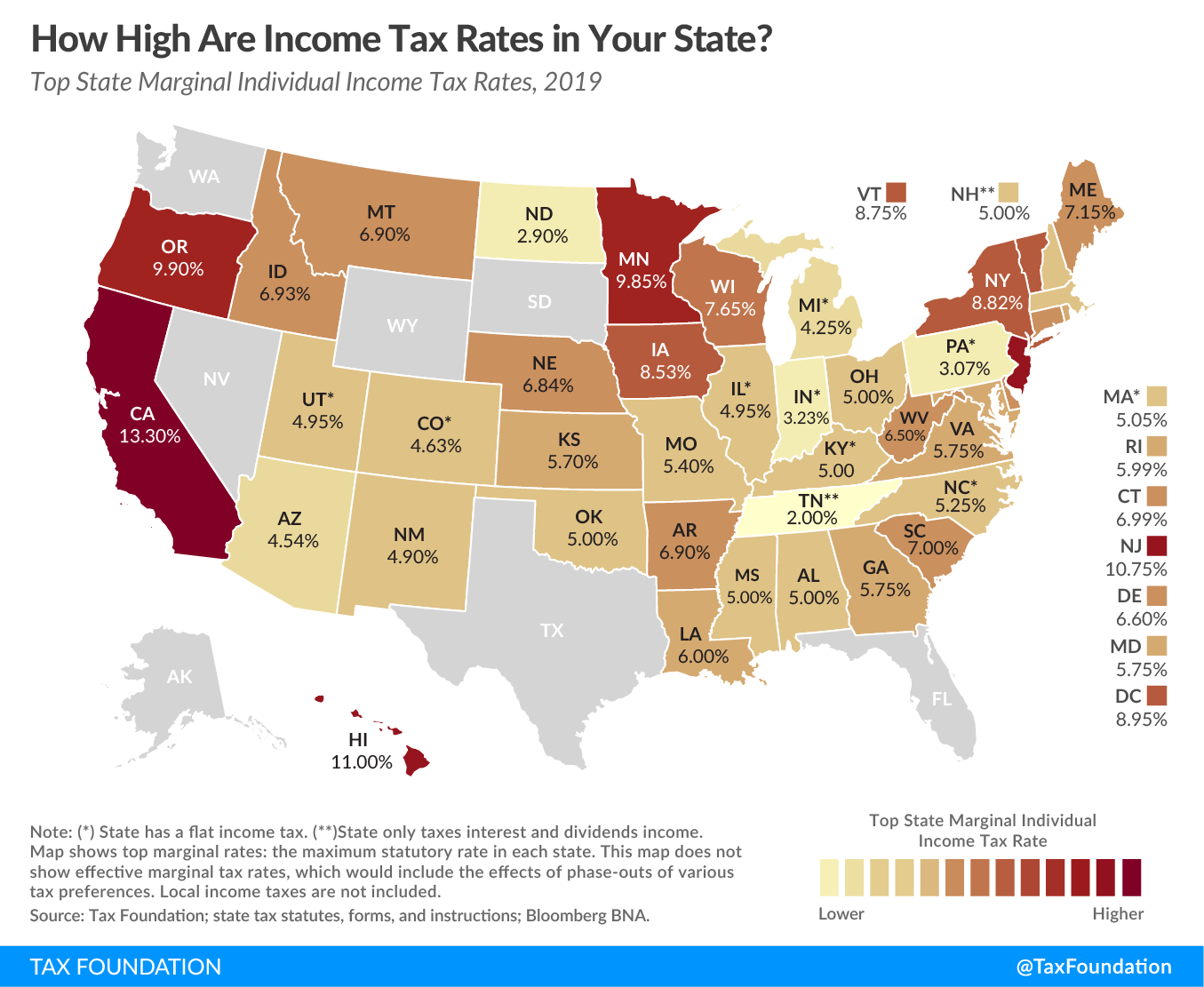

New York and California are famous for their relatively high salaries, but also high state income taxes, as high as 13.3% in the latter. One effect of the Tax Cuts and Job Acts of 2017 (TCJA) was to cap deductibility of SALT against federal taxes to US$10,000/year, especially impacting high income earners in these high tax states.

As of 2019, seven US states have no state income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. Two more, Tennessee and New Hampshire, tax only investment income.

State Corporate Income Taxes

As extreme as Alaska and Florida are on the US map and in their lack of individual income taxes, both have substantial corporate income taxes. Some of the “grey states” on the linked map with no “corporate tax”, instead have a “gross receipts tax”: Nevada, Ohio, Texas, and Washington.

Some States also have State Estate Taxes and Inheritance Taxes

Many people don’t spend as much time thinking about estate and inheritance taxes as about income taxes, since the latter are paid every year while the former only comes due when someone dies. While the TCJA raised the US federal estate tax threshold, the 2015 brackets and rates in the link above show New Jersey death taxes kicking in at only $675,000, and no-income tax Washington state charging 10-20% of estates over about $2,000,000.

Some US State Tax Planning Tips

Most Americans won’t let tax rates drive where they choose to live, work, retire, or even invest, but some planning can provide significant tax savings on the right side of a move between states. One of the most obvious, for cases where you can decide when to take income, is to time taxable income in years when you aren’t subject to high tax income. This may be especially valuable for lumpy tax events like a Roth IRA conversion, which is better done after moving from a high-tax to a low-tax state than vice versa.

This article is not tax advice, but thanks to the Tax Foundation for all the useful pages I could summarise here!