Last month I posted a chart on how stock prices rose 7x more than house prices over the 20th century, which although backward looking, provides some idea of why investors should consider allocating as much of their wealth to stocks as to investment real estate.

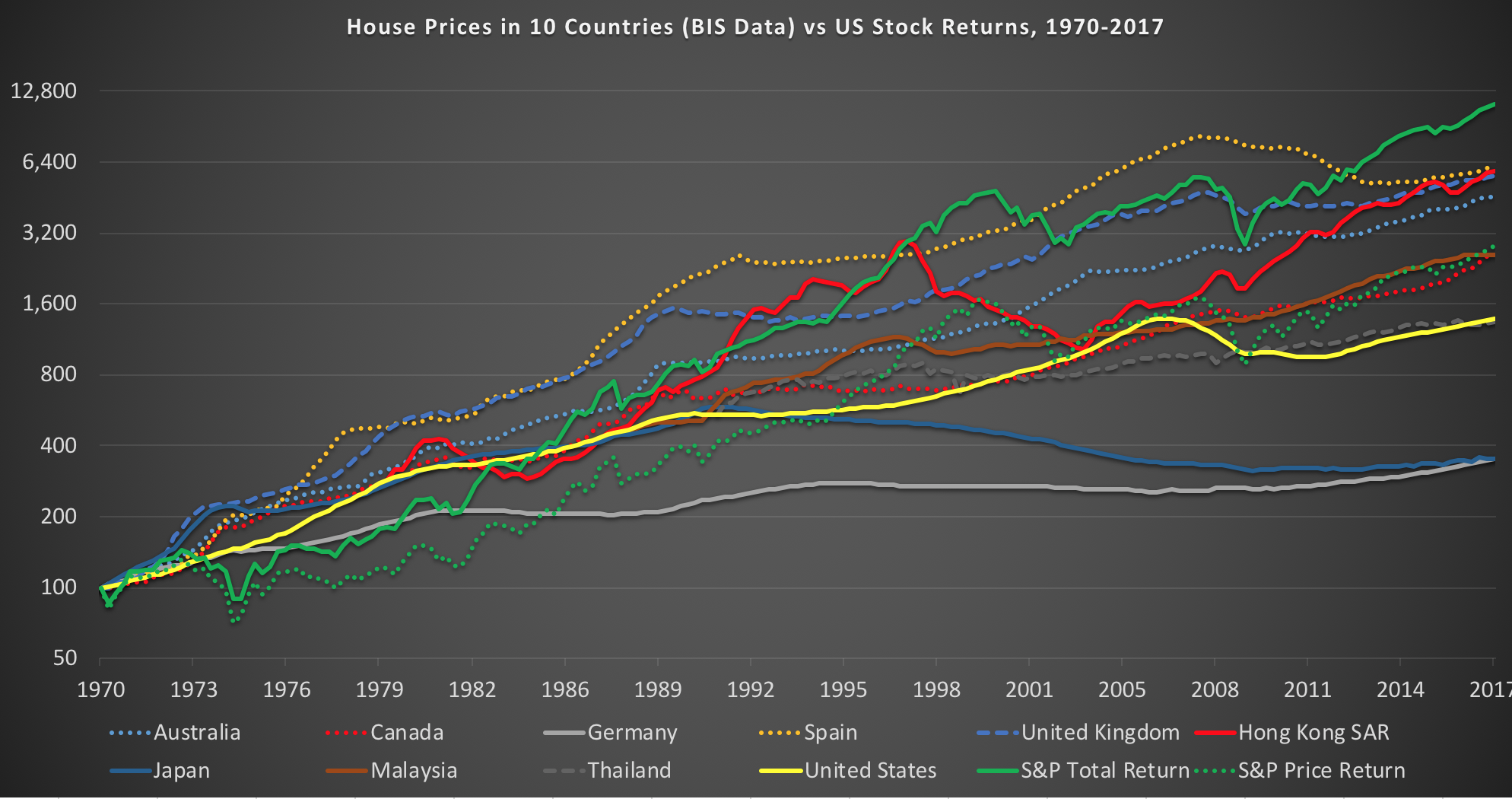

Here I expand the chart with data from the BIS on residential property prices since 1970 on my selection of 10 countries, compared with the price return and total returns of investing in stocks as benchmarked by the US S&P 500 index.

As far as I understand, the BIS data is of residential real estate prices in local currency, not total returns including rental income or taxes/maintenance/renovation costs. So understandably, two of the property markets with the highest price rises are Spain and the UK, both of whose currencies have declined the most since 1970, while Germany and Japan have shown the most modest price rises, as their currencies have mostly appreciated against the US dollar over the same time. Malaysia and Thailand, whose currencies have been mostly stable other than the 1997 shock during the Asian financial crisis, have seen flat price appreciation comparable to that of the price return of the S&P 500 index. Hong Kong has been the one stand out market, with significant appreciation in a currency that has been pegged to the US dollar since 1983, but with a significant ~60% drawdown from 1997-2003.

Moral of the story: International diversification can definitely help reduce the risk, even in an asset class as apparently safe as residential real estate, but it is hard to outperform the long-term total return of stocks unless you are very efficient in improving properties and raising rents as a landlord. Rather, I recommend investors buy and own stocks like a landlord holds and rents out property, and keep in mind that over the long term, property only seems less volatile because house prices are not quoted daily on a stock exchange.

I look forward to hearing from you if you have any questions about how investing in international real estate compares with owning a globally diversified stock portfolio.

Until next time,

Tariq