Over the past week, stock and bond markets around the world have fallen more than many people remember seeing in years. After an amazingly smooth ride up in 2017, when the S&P 500 index rose almost 20% without declining more than 2% on any day that year, investors were suddenly reminded over the past week what stock market volatility used to be like. In just the past 5 business days, this most-followed stock benchmark fell by more than 2% in three of those days, and as of this writing, many markets are more than 10% off highs seen earlier this year, but still well above where they started 2017. When markets fall like this, I am often asked “am I worried?”, “will these markets continue to fall?”, “is this crazy?”, and “is now still a good time to invest with so much volatility and instability?”.

Many people I talk to feel that it is risky to buy stocks, and not so risky to invest in property, and some feel it is easier to make money in real estate than by owning profitable businesses, despite the fact that stock prices rose 7x more than house prices in the past century. The main reason, I believe, is because stock prices are readily available with big bright green and red numbers telling you how much each of your stocks went up or down that day, while website or TV channel is streaming live up and down prices of your apartment to you on a minute-by-minute basis. Even if you wanted to day trade apartments, the very high transaction costs ranging 3-15% of a property’s value would be far harder to overcome than the <0.1% costs of trading a stock. While I’m all for liquidity, transparency, and low transaction costs, I must admit that the lack of these in real estate markets forces property investors to be more long-term and fundamentally oriented buy and hold investors than fair-weather traders who buy stocks high and sell them low.

I look at a well-balanced stock portfolios the same way I look at a portfolio of investment properties: I like the ones I have to keep paying their rent, and continue to own them if I believe I will be able to significantly raise the amount of rent I earn on them over the coming years and decades. A dip in property prices may attract me to buy more if I can find more good yielding assets at a cheaper price than last week, but I would not sell something because its price fell 10%. I would consider selling an investment property if its underlying fundamentals deteriorated: for example, if changes to the local economy, tenancy laws, or zoning laws meant rents would fall rather than rise in the coming years and decades, but not just because the price fell. Similarly, I am not over-reacting to this recent sell-off in stock prices, but using the opportunity to slowly look for more opportunities to buy companies that will be able to collect “rising rents” (in the form of higher cash earnings) over the next decade regardless of most market conditions.

In numbers, you can think of it this way: you own a property that pays you $10,000 per month in rental income. You should expect to collect this rent every month, whether the market goes up or down. Sometimes a property like this will sell for $1,500,000, sometimes it will sell for $4,000,000, depending on how desirable the property is, how likely other buyers think it will appreciate in value, etc., but you should prefer to buy it at the lower end of that range to earn as high a rental yield as possible, and then use that yield to buy other attractively priced properties. In the same way, I prefer to buy stock in a company that is earning $1/share/year at $15/share rather than at $50/share, and watch to make sure these profits actually come back to me in the form of a dividend, buyback, or increase in tangible book value. If I already bought, I no longer care if the price goes up or down, so long as the underlying property or business keeps paying me a good return.

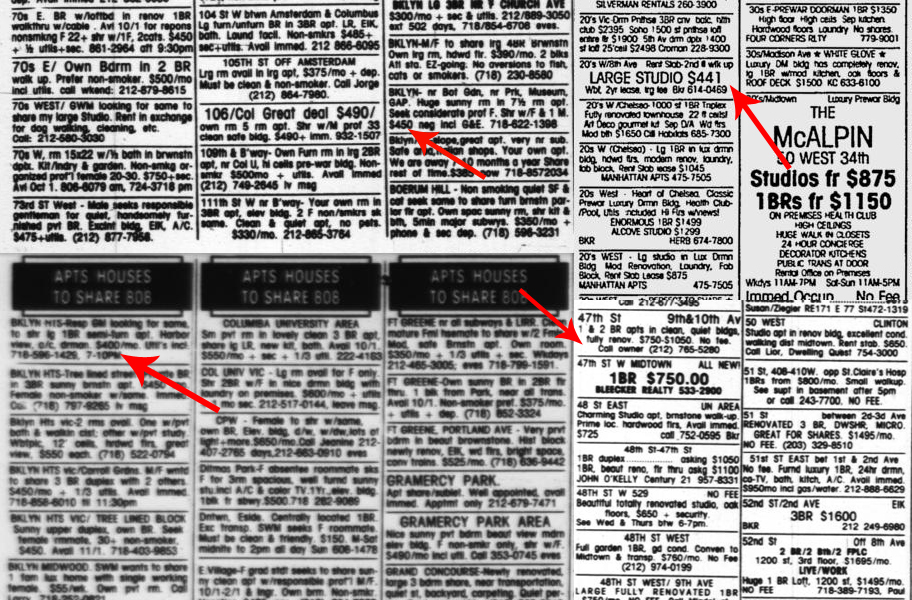

The header image is a picture of some New York City classified ads for apartment rentals in the 1980s from curbed.com. If you know New York, I’m sure you have an idea how many times more than $750/month it would now cost to rent a studio apartment on West 47th street (right next to the MetLife building and JP Morgan’s headquarters). If you bought this apartment in the 1980s and held it until now, you not only would have multiplied your money in terms of market value, but also would have made it back in all those rising rent payments you collected, which you would not have had if you put your money in gold. More data on how NYC apartment prices and rents have changed are available in this report and this article. As a benchmark, $10,000 invested in an S&P 500 total return fund in 1985, with dividends reinvested, would have grown to $250,000 today.

There are people who like to buy properties that are not yet finished and do not pay any rental income, just like there are people who like to buy shares in companies like Tesla that are not yet profitable, but that is a very different investment approach, perhaps tested in the data point that Tesla shares are now over 20% off their highs vs. the S&P’s 10%. If you bought the property that pays you $10,000/month for $3,000,000, and it’s now valued at $2,700,000, that may not feel good, but it’s still a much better situation than paying $3,000,000 for an apartment that is not finished, not rented out, and then the market makes it likely that its completion and rental may get delayed, or even cancelled, especially if the developer had too much debt and goes out of business. The latter type of decline is the one I watch out for far more cautiously.

Do you agree with this comparison of property rents and stock earnings? Happy to hear your thoughts if you’d like to contact me through the form below.