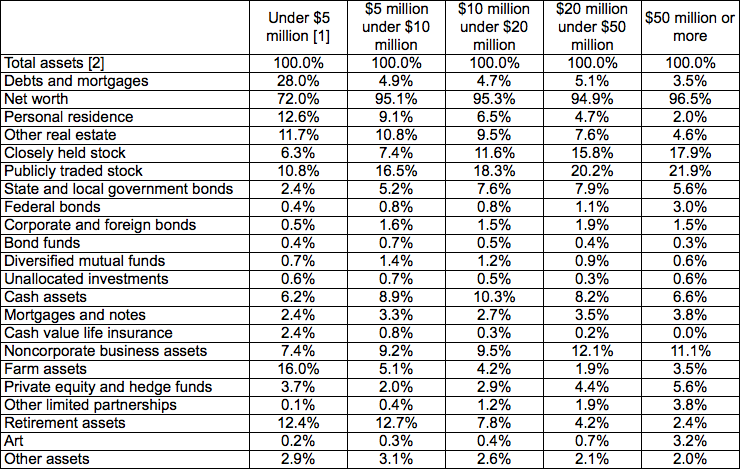

When considering which asset classes to invest in, it makes sense to ask “what do the wealthy invest in?”. First generation American millionaires tend to earn more of their wealth from their investments than directly from their salaries, and so one guide for deciding which of the many different types of investments best build wealth is to see what do the wealthy invest in and continue to own, even after they become wealthy. Below is a useful table I calculated from the IRS SOI statistics on where the wealthiest 584,194 Americans (about the top 1.7%) hold their wealth.

Reading the below table row by row reveals the following, perhaps not too surprising, patterns:

- The ultra-wealthy have far less debt than those with net worths under $5mio

- The wealthier an American household gets, the lower the percentage of wealth is tied up in the value of their home

- Those with net worth >$50mio actually own less investment real estate / property than those with net worths between $5-10mio or $10-20 mio, both in absolute amount and in percentage of their wealth.

- What ultra high net worth individuals do own dramatically more of than less high net worth individuals is stocks, both publicly traded stock and closely held stocks in their own or family businesses, as well as non-corporate business assets. Together, these three categories make up about 50% of the $1.8 trillion net worth of the 14,369 households with a net worth over $50 million.

- The wealthier are less likely to own cash value life insurance, such as whole life or universal life. In an earlier post I showed the math of how investing in insurance policies generally adds up to terrible returns.

- Cash seems to take up about 6% of both the under $5mio and over $50mios, and slightly more of those in between. I am guessing this includes short-term bond and money market funds, and would explain what keeps short-term interest rates low.

- The ultra-wealthy have somewhat more invested in art, and far less invested in farms.

- The wealthier own about the same percentage of their wealth in diversified mutual funds, far less in retirement accounts, and only slightly more in private equity and hedge funds than less high net worth individuals. It should be notable how much smaller a fraction of their equity exposure the wealthiest own via funds than through owning stocks directly, a main reason I advocate most investors own stocks directly rather than through funds.

#3 and #4 are likely to surprise most investors in Asia, who often think of property and insurance as the main places to invest, but US data has shown stock prices have appreciated 7x more than house prices over the past century.

Below is table on the number of households and total amount of net worth covered by these statistics, from the IRS spreadsheet.

Do any of these statistics surprise you, or make you think differently about how much to allocate to stocks vs funds or property? Looking forward to hearing from you in the form below.

One thought on “What do the wealthy invest in? More stocks than funds or properties, according to the IRS”

Comments are closed.