My latest article describes how to choose the 10 first stocks to buy a 10-year old, and why I think it’s important to start kids investing in individual companies rather than mutual funds from an early age.

As I disclose: I bought Coca-cola for my older child and PepsiCo for my younger child because they are simple business models for them to understand, and I think the sibling competition provides even more motivation. They have been debating whether the next one they want to own is Apple, Amazon, or Google / Alphabet, and in the article I lay out how I plan to help get them into the rest of their first 10.

This article already got over 20,000 reads in the first weekend, and I’m glad to see the comments different stocks or factors to consider, such as the question of why I focused on financial profitability rather than social responsibility in this article. I like the debate so long as it motivates, rather than hinders, the goal of getting 10-year olds to become financially literate and start buying their first stocks.

For “shorter-term” goals like college savings (which a 10-year would tap into within 10 years), a 529 plan does still offer some of the best tax advantages for US taxpayers, and I criticise this disadvantage versus pre-teens in Hong Kong (or other places that don’t tax investments) in choosing mutual funds vs single stocks to save for college.

For a longer term goal like accumulating wealth for retirement, a 10-year old’s long time horizon shows the power of compounding. From age 10 to 66, an investment that doubles every 7 years will have the chance to double 8 times, or multiply an initial investment of $10,000 into $2,560,000. Choosing 10 good and durably profitable companies, and rebalancing accordingly, is important to keeping the money growing at this pace.

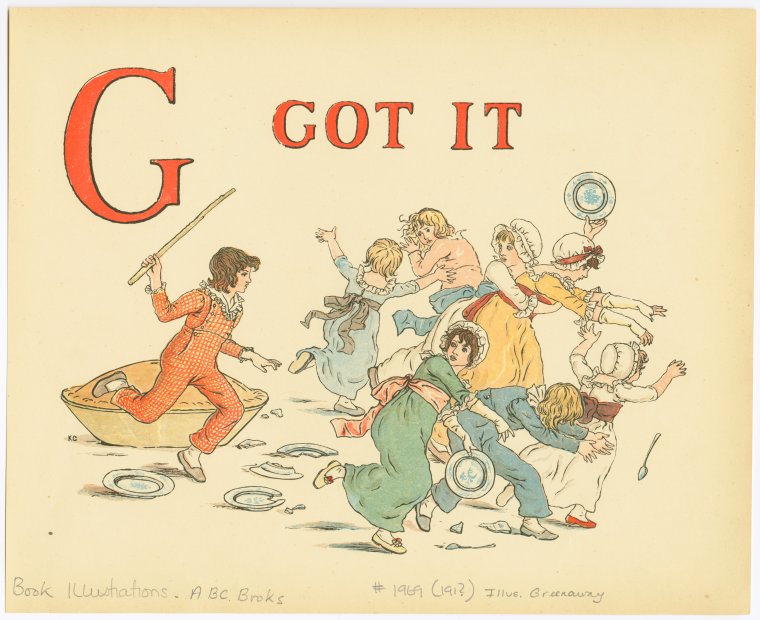

Image source: NYPL Digital collections