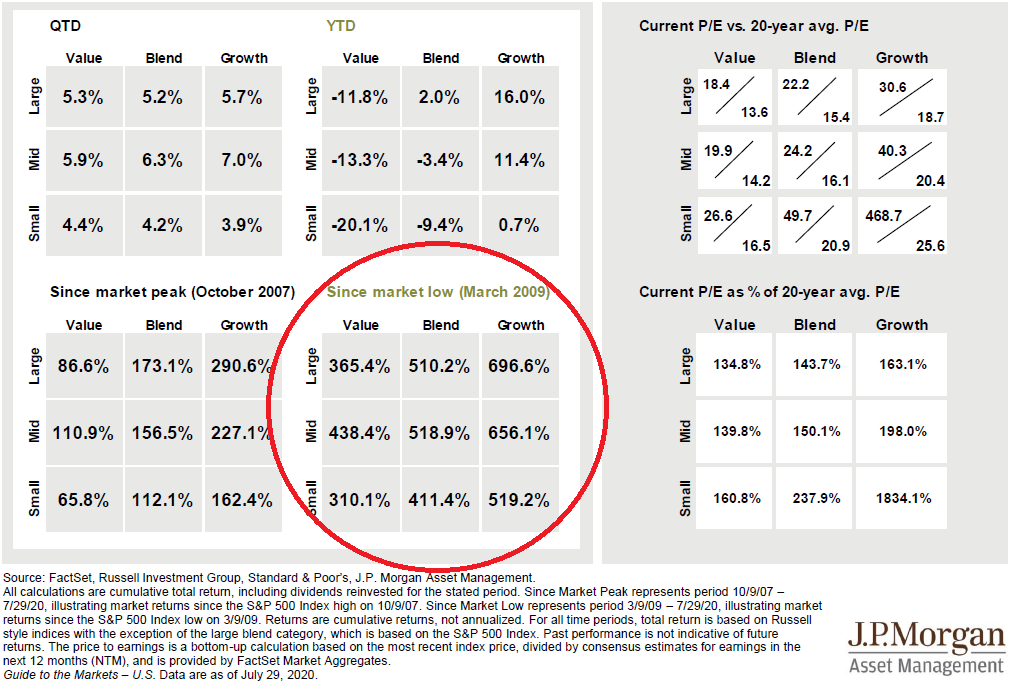

One tweet I found worth sharing today was this one by @NateGeraci showing JP Morgan’s 3×3 grid of past performance and current P/E ratios of large caps vs small caps and growth vs value stocks. Fans of Morningstar will be very familiar with the 3×3 style grid idea from there, and I have also written several posts here comparing large cap growth to small cap value, and the recent outperformance of the former to the dot-com bubble of 1999.