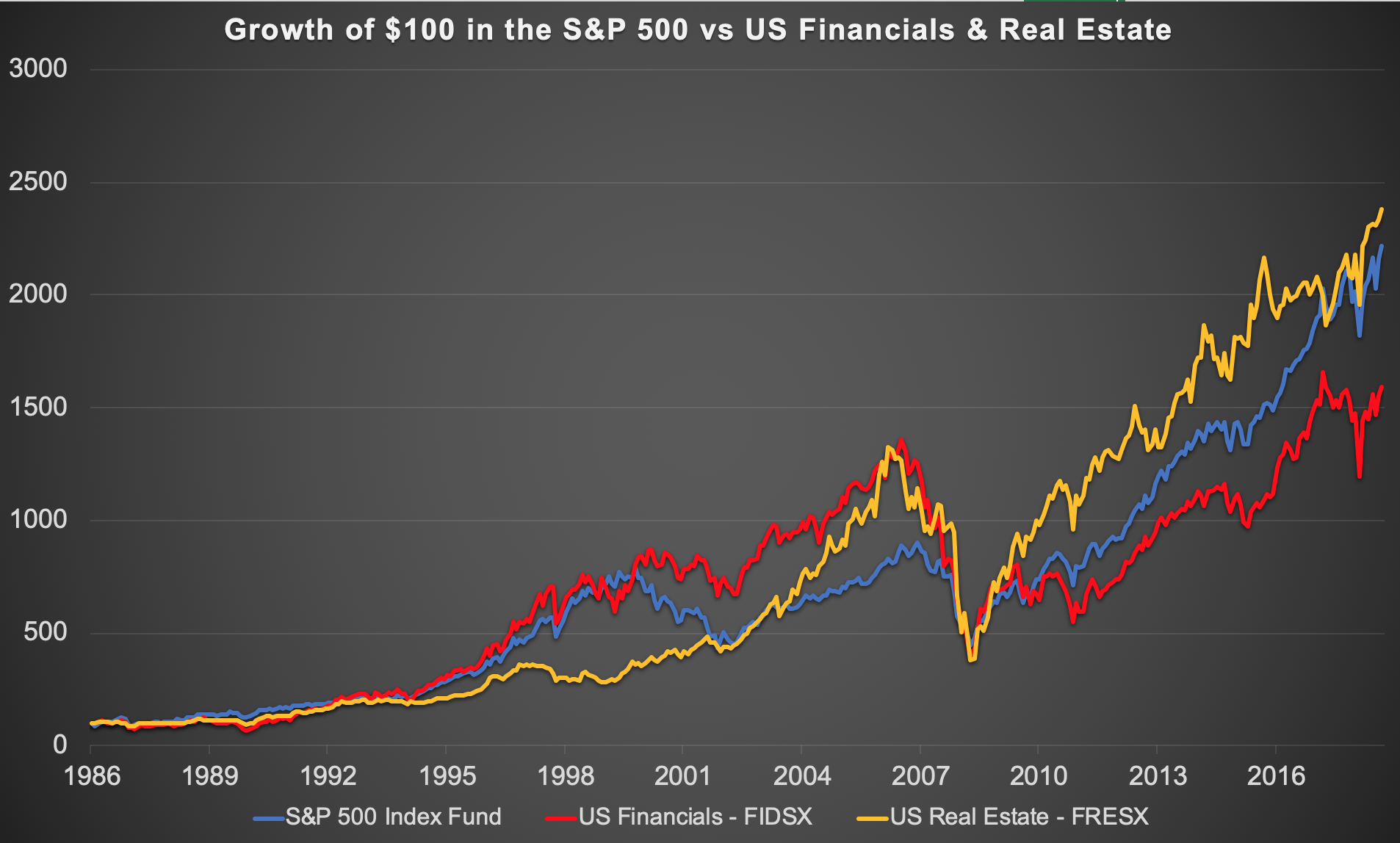

Today’s chart in the sectors category plots what would happen if you only invested in either bank stocks or REITs, rather than the overall market. Financial analysis and accounting courses often treat financials separately, because financials like banks and insurance companies don’t really have “revenue” like other businesses do, and REITs are more about assets and cash flows than “earnings”.

I have shared several posts on the topic of investing in real estate / property vs stocks, including one paper from Harvard, another from Yale, one comparing property markets of 10 different countries, and another comparing private REITs vs physical real estate. Overall, the result is that a REIT only portfolio seems to have similar long-term returns to stocks with slightly higher volatility, especially including the 2008 crash.

Banks and financials on the other hand, seem to be quite another sector. US banks, as the chart below shows, bloated in the first decade of the 2000s and crashed spectacularly in the 2008 financial crisis. Outside the US, especially in emerging markets, banks often make up a significant part of a benchmark index, and are the main listed way for investors to access the equity portion of a managed local credit portfolio. As the below video clip for Warren Buffett and Charlie Munger, answering a question from Bill Ackman, elaborates, financial companies employ far more leverage than other sectors and so are far more vulnerable to small errors on one side or other of the balance sheet, which are arguably easier to err on financial than non-financial companies. This is why for many emerging markets, the first division I make is not between growth vs value, or high vs low dividend, or any other metric, but between financials vs non-financials.