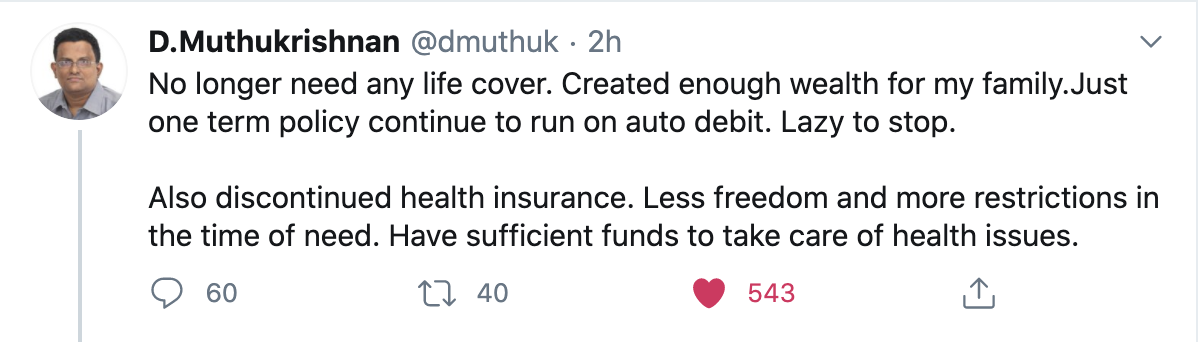

One of the more thought-provoking tweets I saw today is by India-based financial planner @dmuthuk, who tweeted that he no longer needed life or health insurance.

This may sound like an unusual goal for a non financial planner, but one of the more objective ways of measuring whether or not you have reached your financial goals is whether or not you still need insurance against anything derailing your progress towards them. Think about it:

If you really don’t need life insurance, it’s because you either have no financial dependents, or you have enough saved and invested to take care of them for decades even if you die without insurance.

If you really don’t need health insurance, it’s because you have saved and invested enough to cover a wide range of expected (and unexpected) medical expenses. In the US, I might still recommend a high-deductible health plan paired with an HSA, but in India and many other countries, a mass affluent retirement portfolio would probably cover most medical bills.

If you really don’t need disability insurance, it’s because you have enough saved and invested to be OK even if you are physically unable to work.

If you really don’t need liability insurance, it’s because you have structured your asset protection plan to protect against lawsuits and other risks of others coming after what you’ve saved an invested.

I could go on, but hopefully these lines have inspired you to think of your financial plans, your progress towards them, and your insurance against what might endanger them, in a clearer way.