One reason I hear some investors are uninterested in buying foreign-listed stocks is that they believe the foreign revenues of some of their home-based companies already provide enough international diversification. The classic example is Coca-Cola, whose sales have spanned over 100 countries for years, so arguably Coca-cola is more like a “global portfolio” than a pure “US stock”.

Today’s chart is thanks to Meb Faber for sharing a link to the Morningstar revenue atlas study.

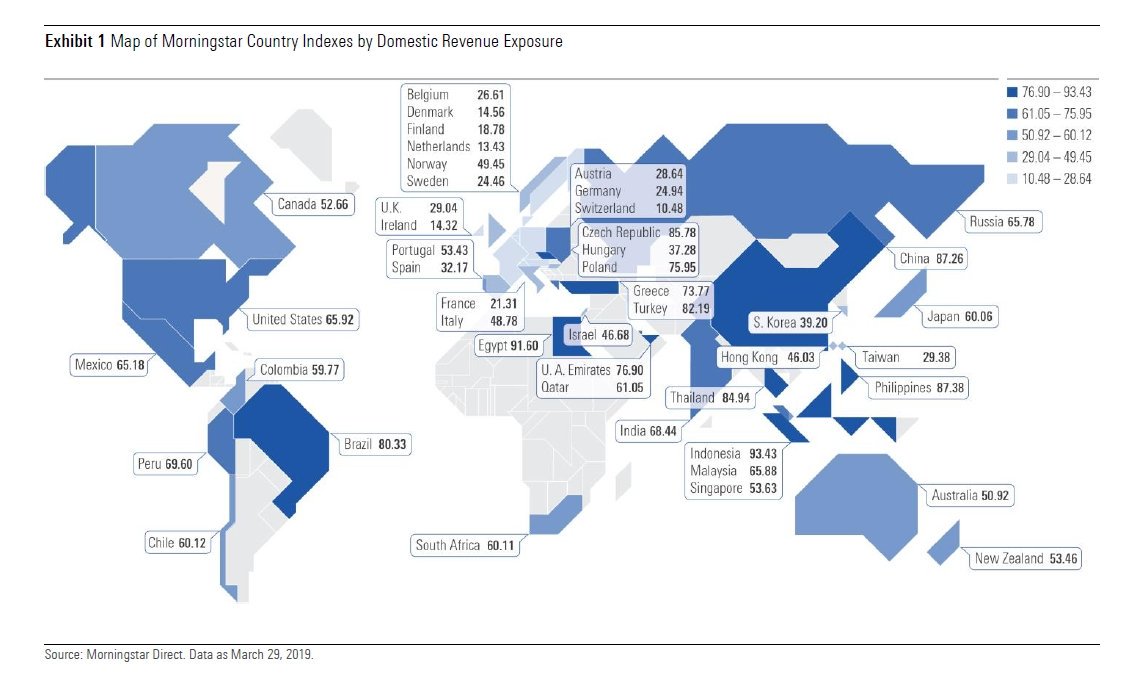

This chart / map shows what percentage of the revenues of each country’s stock market is domestic. For example, it shows that about 66% of revenues of US listed companies come from the US, meaning an investor with a US total stock market ETF like $VTI or $ITOT would already own businesses earning about 1/3 of revenues from outside the US. Contrast that with all-world ETFs like $VT or $ACWI, where about 45% of the portfolio is in foreign listed stocks, some of which have their revenues from the US, and we can see the latter provides significantly more international diversification, but not totally. US companies are somewhat in the middle in terms of percentage of domestic revenue, with European countries typically having far lower percentages (much of the 75% of foreign revenues of German companies come from nearby Eurozone members) to even more domestically oriented markets like China, Indonesia, and the Philippines, with almost 90% of revenues domestic (contrast that with China’s export surplus numbers).