Many Americans living outside the US have visited their local bank to be told that they are not allowed to purchase investment products outside the US, often without being told any more details as to why not. While Americans can and should directly own investments outside the US (I personally own and buy for US clients shares of high-quality non-US stocks, and personally own and recommend owning non-US real estate), there are specific pitfalls around US taxpayers buying non-US mutual funds which make these investments a 4-letter word to Americans overseas, and that 4-letter word is “PFIC”.

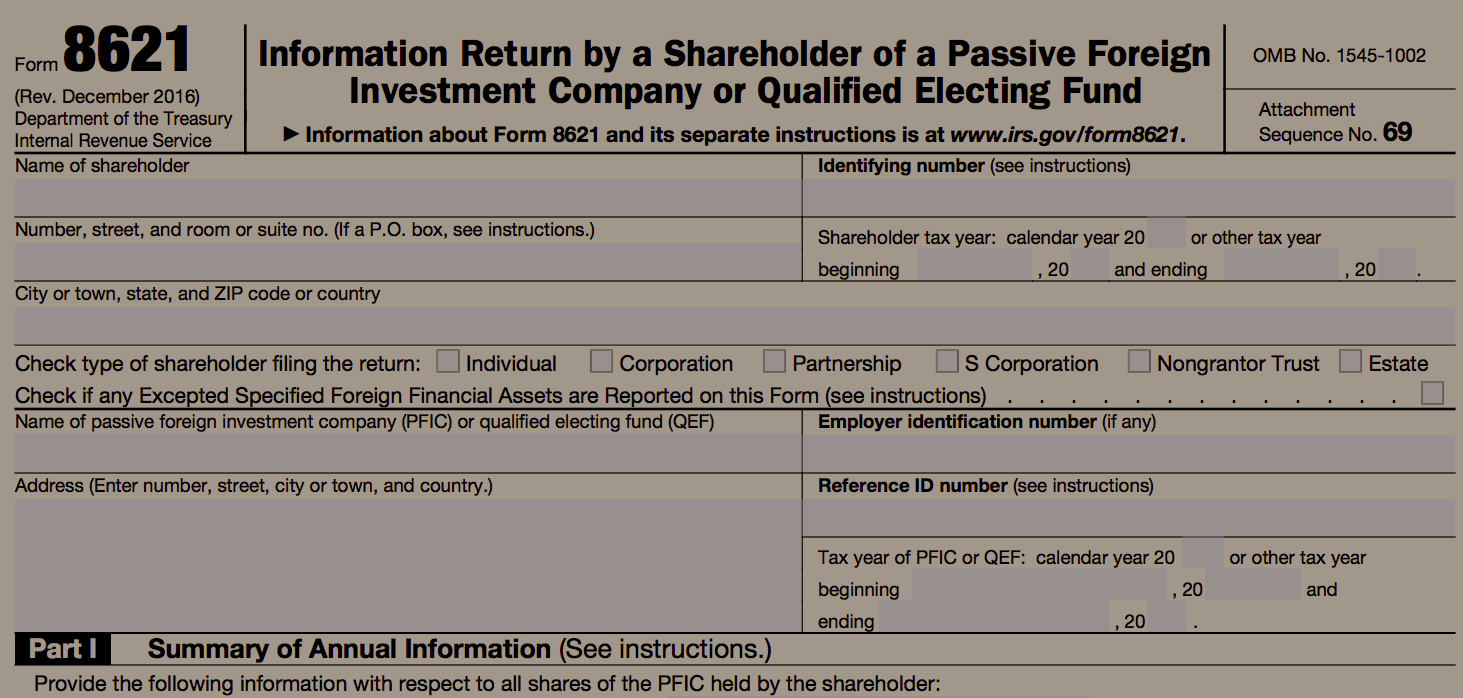

“PFIC” stands for “Passive Foreign Investment Company”, and generally refers to non-US mutual funds as far as US taxpayers are concerned. The “passive investment company” part refers to the fact that US mutual funds generally must comply with rules to pass through interest, dividends, and capital gains distributions to their investors so that the investor pays tax on these every year on their US income tax return (or defers these taxes by holding them in an IRA, 401k, or other tax-deferred account), and both the fund and investor have to report all this to the IRS. Non-US mutual funds are subject to different rules, do not have to report to the IRS, and often are allowed to accumulate interest, dividends, and capital gains for reinvestment within the fund. For non-US investors, I have posted lists here and here of some of the non-US ETFs I consider for accounts of non-US clients (since HK-based clients are often subject to 30% withholding tax on distributions from US funds), but US investors should generally avoid buying any non-US mutual funds or ETFs, or otherwise face having to file IRS form 8621 and pay punitive rates of tax on these investments. Derren Joseph has also posted this LinkedIn article on PFICs, as well as this one by TMF’s Yuseff Murphy.

Americans who have a choice should generally prefer to directly own shares in foreign stocks (which is what we do), or access foreign markets through US-listed exchange-traded funds (ETFs). Unfortunately, many Americans living and working outside the US may have no practical choice to avoid owning foreign mutual funds in employer-sponsored retirement plans like Hong Kong’s mandatory provident fund (MPF) or employers’ superannuation funds in Australia.

Conversely, the ACA has also written about restrictions against American citizens abroad buying US mutul funds here: https://www.americansabroad.org/mutual-fund-restrictions/

Of course, nothing in this post is to be taken as tax, legal, or investment advice, and we highly suggest you speak with your own tax and legal advisors, or contact us if you would like to discuss investments.

2 thoughts on “PFIC: How Non-US Mutual Funds are a 4-letter word to Americans Overseas”

Comments are closed.