Last month, the Hang Seng index made the historic move of replacing Cathay Pacific with a mainland Chinese company, as part of the longer-term trend of Greater China integration in the index. At that time, I pointed out that Singapore Airlines’s position in the Straits Times index was far more secure, but today we see a change in the Singapore benchmark representing another trend: the replacement of an “old economy” retail-related logistics company with the first tech company in the Straits Times Index.

This is not exactly an “Amazon replacing mall REIT” story, as Venture Corporation (SGX:V03) makes electronic products, many of which are used by retailers, which is not as purely scalable as a software-only service company. The departing Global Logistic Properties (SGX:MC0) could be considered more related to the Amazon story, as increasing online shopping and just-in-time logistics (a trend that has been developing 20+ years and counting) fortunately means far less of the world’s real estate will be taken up by warehouses.

This seems far less significant to me than the Cathay-Hang Seng change, and as much as Singapore has been trying to develop itself as a tech hub of Asia, it may still be many years before the Straits Times index has any serious exposure to what Silicon valley would call technology. Beyond Asia’s historic emphasis on commodity electronics manufacturing, Singapore might best hope to stay competitive as a Fintech hub and have a few listed Fintech companies compete for a top spot in the STI in the coming decade.

Source: SGX

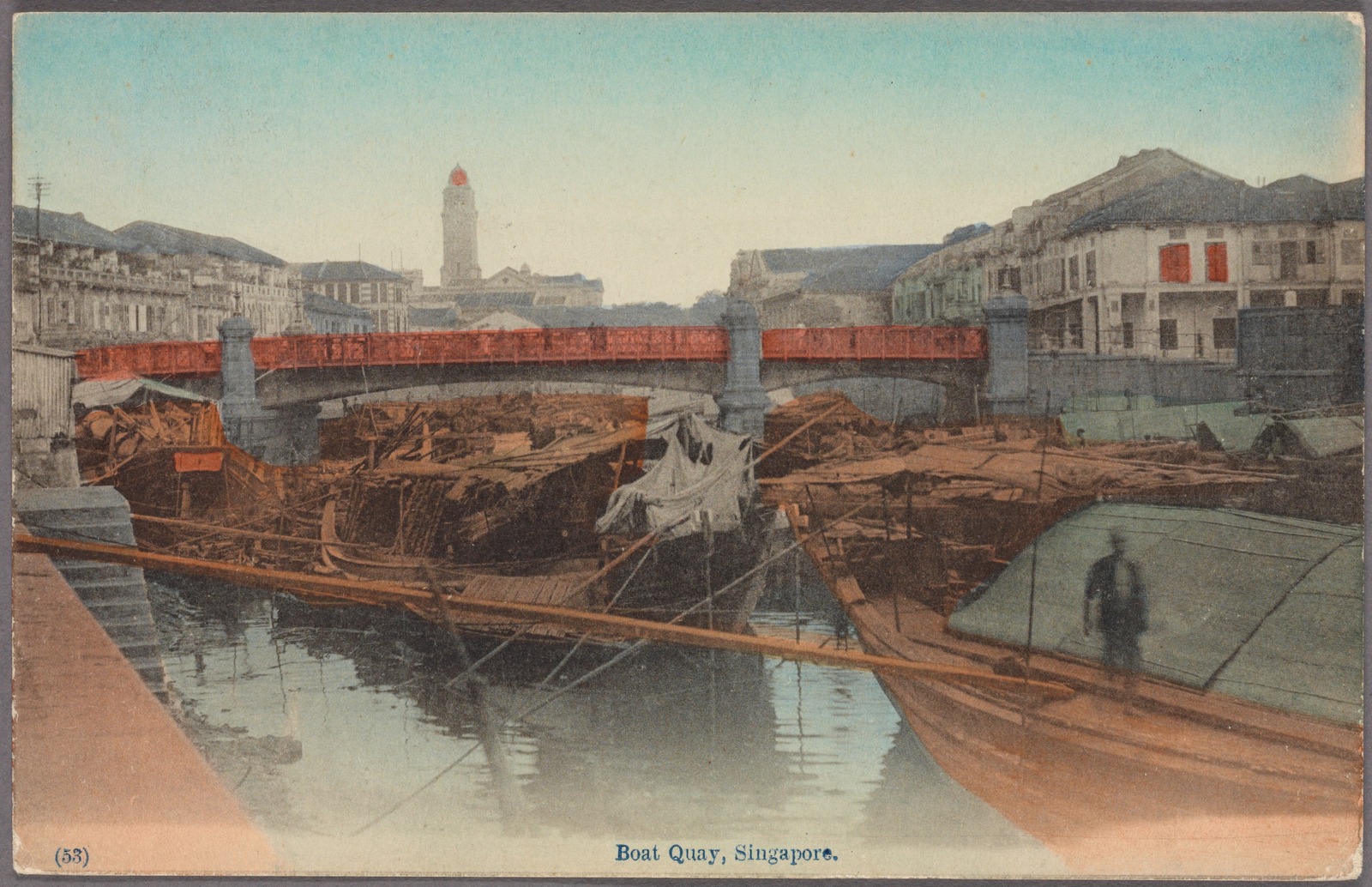

Header photo credit: NYPL Digital Collections