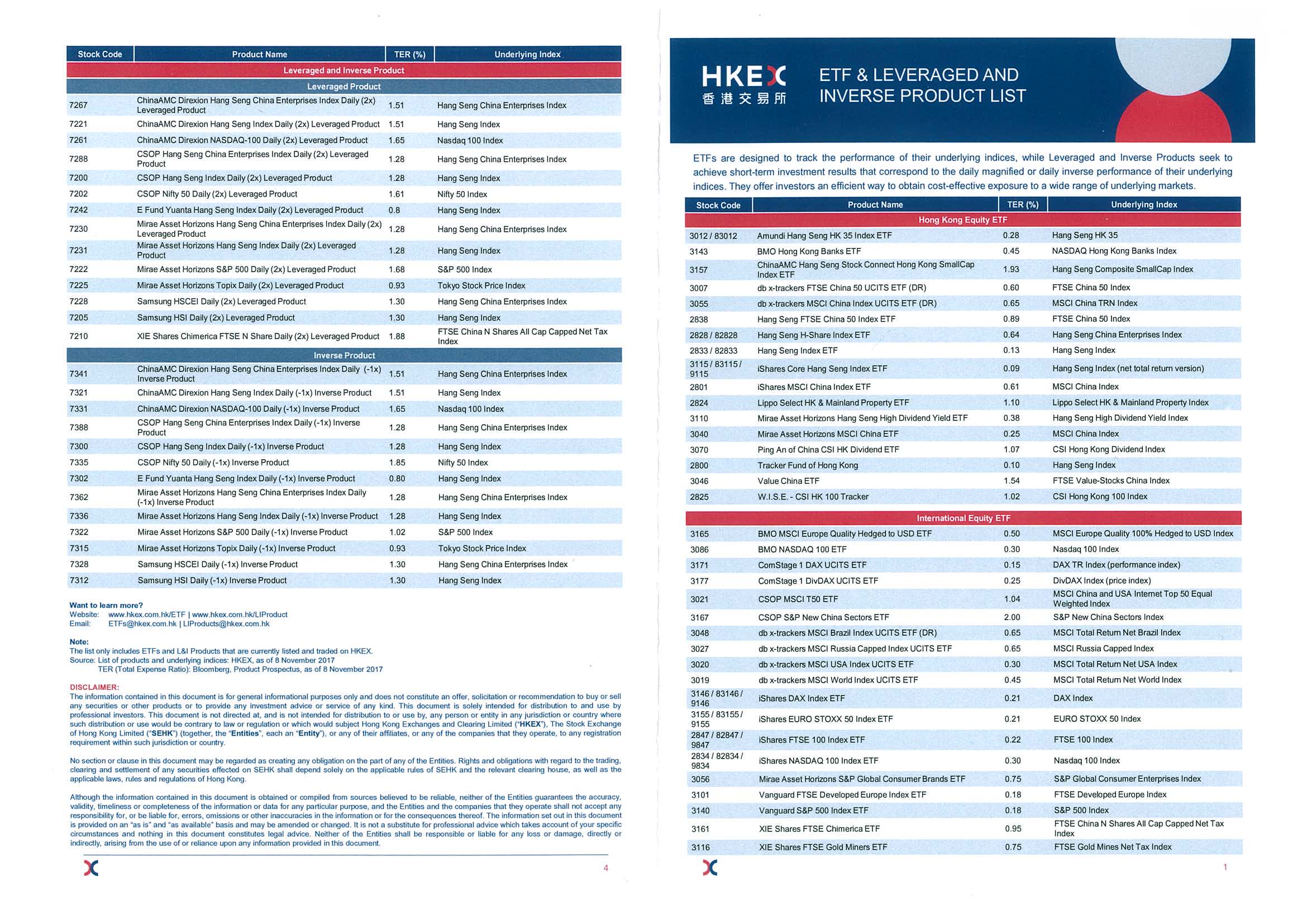

Hong Kong ETFs are, and are likely to remain, the best way to trade and broadly allocate to China, it is not hard to argue that Hong Kong has the best ETF market in Asia. As a reference, I am posting below a scan of the brochure the HKEX handed out at a recent ETF conference, which I have found valuable to keep handy on my desk. For reference (as the scan is blurry), two other sources of up-to-date data on Hong Kong ETFs are AAStocks and of course the HKEX itself. For reference, I earlier posted a short list of my top London-listed ETFs.

The main questions I ask when looking for an ETF are: A. does the ETF provide access to something distinctive that I want to invest in that I can more easily invest in with the ETF, B. is the ETF low cost, and C. is the ETF liquid?

Based on this, my working short list of Hong Kong ETFs includes:

- The Vanguard ETFs: 3140.HK, 3101.HK, 2805.HK, and 3126.HK, covering the US, Europe, Japan, and Asia ex-Japan respectively

- Some bond ETFs: 3141.HK, 3199.HK, and 2819.HK – given the increasing need for income by Asia’s ageing population, I’m very surprised there aren’t more bond ETFs with more liquidity.

- An Asia REIT ETF: 3121.HK

- China A-shares: The new Premia Partners China A-share smart beta ETFs 2803.HK and 3173.HK are very interesting alternatives to the CSI 300 benchmark 3188.HK or the less diversified A50 ETF 2822.HK.

- And of course the original 2800.HK tracker fund of the Hang Seng Index, which has become more and more an H-share index than a purely Hong Kong index

US-based investors looking for “Hong Kong ETFs” may be steered to the iShares EWH, FXI, and CNYA, tracking Hong Kong companies, H-Shares, and A-shares respectively.

Hopefully this was a useful list, do feel free to contact me with any questions.