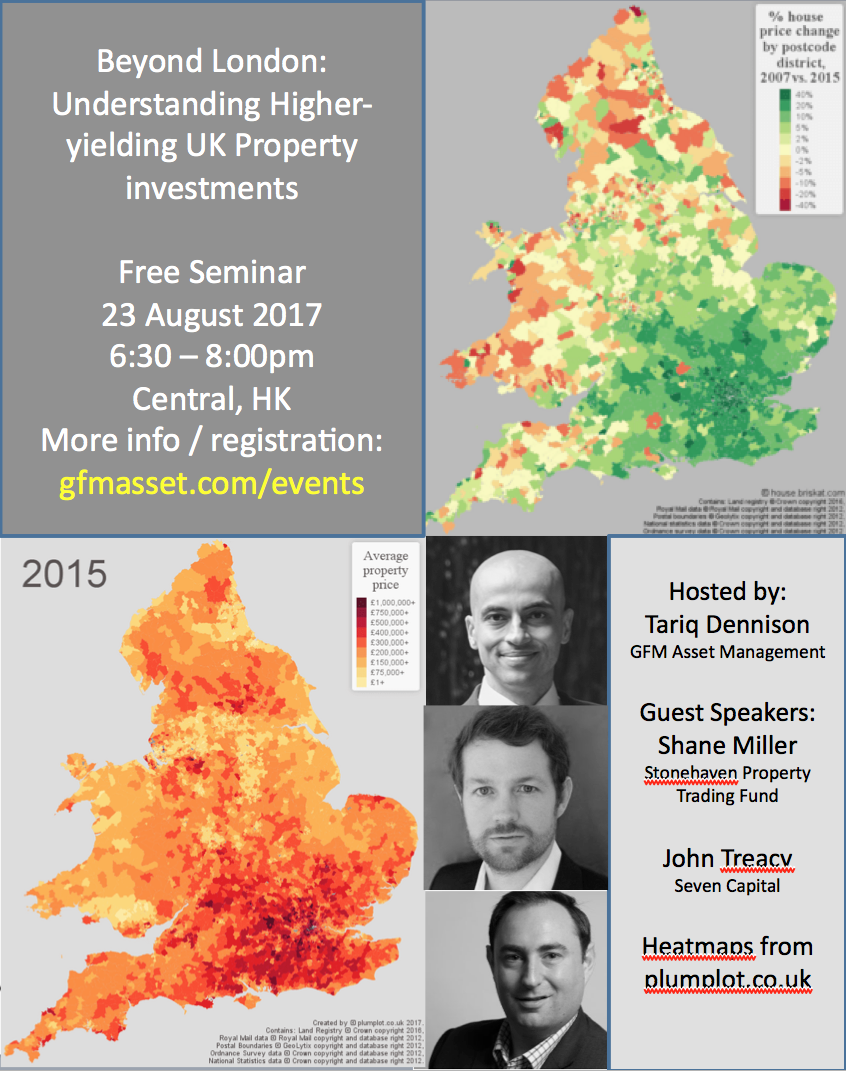

UK Property remains a popular asset class for Hong Kong based investors, but a weaker pound and continued demand to own a space in one of the world’s leading cities are driving London property prices to new highs and their rental yields to new lows. Fortunately, there are still many opportunities for higher returns outside of Greater London that also benefit from the UK’s strong legal protections, favorable tax treatment of foreign investors, and competitive long-term fundamentals. This seminar will mostly focus on UK property markets within England and Wales.

This seminar goes beyond the all-too-common sales pitch for off-plan London properties to HK-based investors and instead discusses:

1. UK Listed Real Estate Investment Trusts (REITs) a way of earning rental yield with greater flexibility and liquidity

2. How investors can earn higher returns by having cash ready to buy low from motivated sellers

3. How cities like Birmingham offer more upside potential than London, and

4. How to protect the value of UK investments against further declines of the Pound

Tariq Dennison CFP manages discretionary investment portfolios at GFM Asset Management (www.gfmasset.com) and has over 15 years experience in macroeconomic and REIT investing.

Shane Miller manages the Stonehaven Property Trading Fund, which has averaged returns of over 15% per year by investing in accelerated sales of properties around the UK.

John Treacy is international sales director at Seven Capital (http://www.sevencapital.com/), one of the UK’s largest buy-to-let developers.

Register on EventBrite

One thought on “August 23rd Seminar "Beyond London: Understanding the UK's Higher-Yielding Property Markets" in Central Hong Kong”

Comments are closed.