There are still two more months before the April 16th, 2017 deadline to make a 2016 contribution to your Individual Retirement Arrangement (IRA) account, and whether you open one with GFM or continue with your existing provider I will usually encourage you to “just do it” if you have qualified earned income. I have separate posts on questions like whether to do a Traditional vs Roth IRA, but here just want to address the “Million Dollar Difference” a $5,500/year contribution makes.

As encouragement, we are waiving the minimum for new clients who set up an automatic monthly savings plan of US$450/month or HK$3,500 into a GFM-managed IRA account. The management fee on these entry-level accounts remains at the same percentage, charging only US$0.45 per month per $450 contribution to begin taking advantage of the #MillionDollarDifference explained below.

US$5,500 per year may not seem like much, and that’s exactly why it’s often best to just set IRA contributions on autopilot without overthinking it. If you haven’t made your 2016 IRA contribution yet, you can write one check for US$11,000 to cover your 2016 and 2017 retirement savings in one go. Or, you can simply set up an automatic transfer of $450/month to automatically cover each year until your income or these limits change.

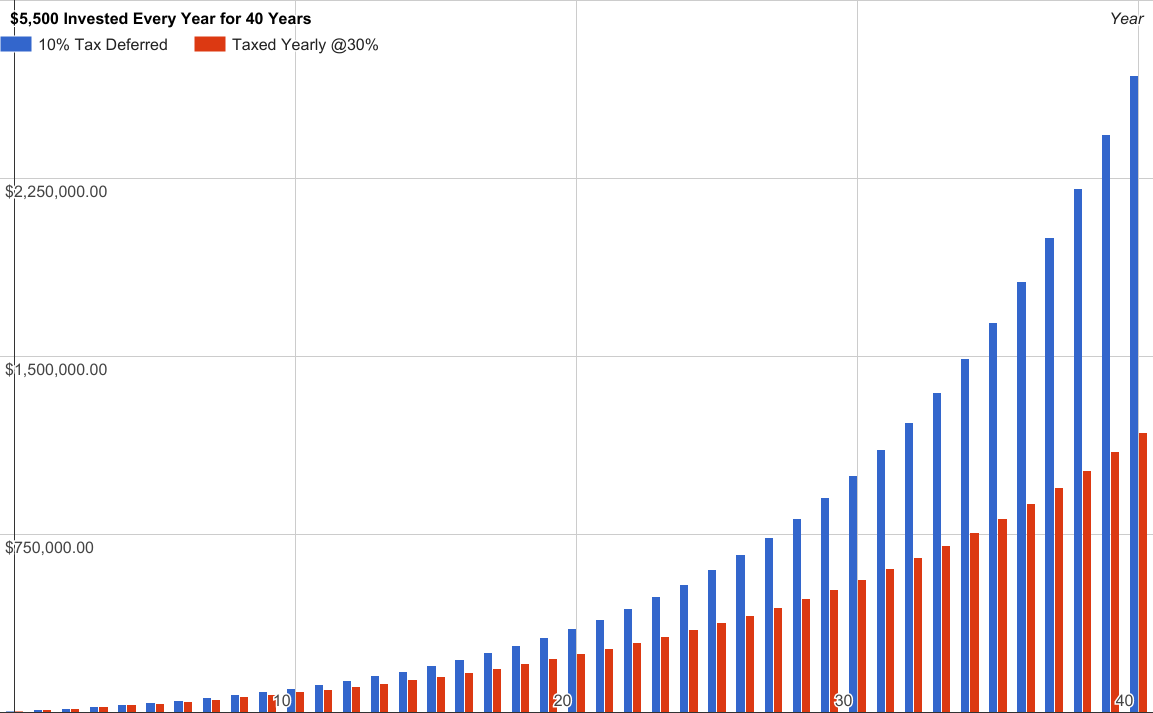

Below I show the difference between $5,500/year invested at 10% with full tax deferral vs earning the same 10% while paying 30% tax every year. In short:

- IRA contributions of $5,500/year add up to $165,000 and $220,000 in 30 and 40 years, respectively

- Invested at 10% and paying 30% tax per year, the account grows to $560,000 in 30 years and $1,180,000 in 40 years, BUT

- Invested at 10% with taxes deferred, the account grows to $1,000,000 in 30 years and $2,680,000 in 40 years.

So while each year’s contributions and tax savings may seem small, compounding combined with tax deferral makes a $1,500,000 difference between deferring taxes in an IRA vs not taking advantage of the IRA, several times the amount of money put in.

This million dollar difference may seem far in the future, but this is often one of the easiest and most automatic million dollar differences available to US taxpayers, especially those under the age of 40.

Until next time,

Tariq

Skype: tariq20776

One thought on “Funding your 2016 and 2017 IRA now and automatically – the #MillionDollarDifference”

Comments are closed.