This is an summary and excerpt of my article “Why I Wouldn’t Invest More Than $100,000 In An S&P 500 ETF Or Index Fund“.

Ask 100 fee-only financial advisors how they would invest an extra $100,000 that was not needed for at least 10 years, and odds are that one of the top responses would be to simply buy and hold a low-cost, broadly diversified index fund or ETF.

This article makes no attempt to debate whether to invest in active vs. passive funds, nor whether the S&P 500 is the right or best index to use as a benchmark vs. any other index. Rather, I explain below how an investor may decide to track an index like the S&P 500 through a passive portfolio of direct stock positions instead of through an index fund or exchange traded fund (ETF).

How To Track The S&P 500 As Completely As Possible

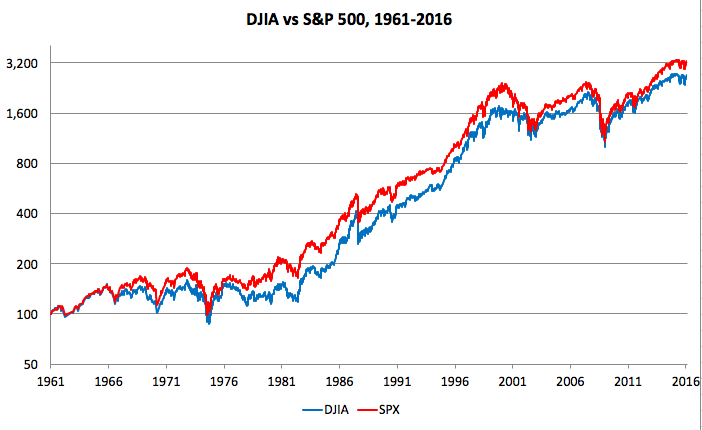

The Standard & Poor’s 500 index remains one of the most, if not the most, liquid and widely used investment benchmarks in the world. Ask 100 traders how they would invest US$1 billion in “the market” as quickly as possible, odds are that the top answers would include buying either S&P 500 futures or an S&P 500 ETF. The SPDR (Standard & Poor’s Depository Receipt) S&P 500 ETF (NYSEARCA:SPY) is the oldest (founded 1993) and still by far the most liquid S&P 500 ETF, but is no longer the largest ETF, or even the largest S&P 500 ETF, having been surpassed in size by the lower-cost Vanguard S&P 500 ETF (NYSEARCA:VOO), whose management company pioneered low-cost S&P 500 index funds with the Vanguard 500 Index Fund (MUTF:VFINX) back in 1976.

…

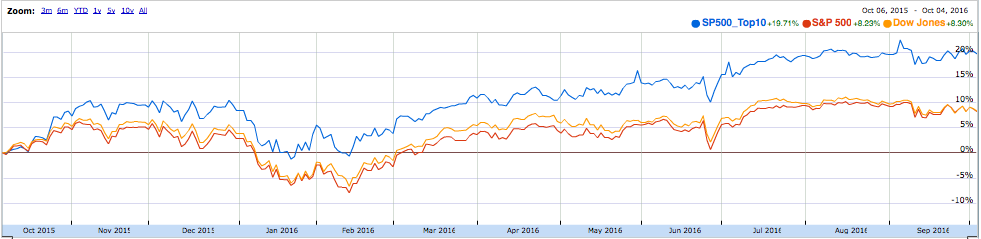

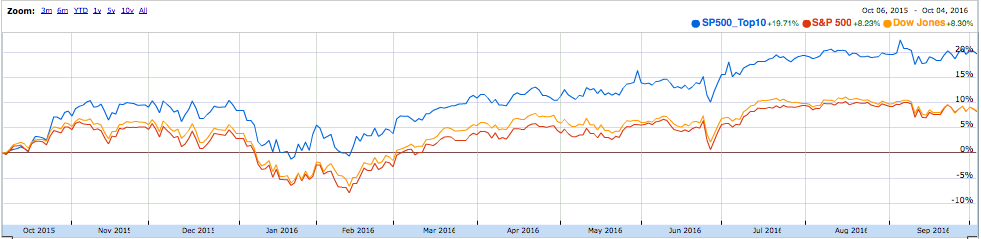

How To Track The S&P 500 “Closely Enough”

For an investor with $100,000 to invest, it would not make sense to buy shares in all 500+ stocks in the S&P 500, but it is not difficult to track the index “closely enough” with a smaller number of securities. Alongside the questions of how actively or passively a stock portfolio should be managed are the debates on how many stocks are needed to provide enough diversification for an investor.

One thought on “Advantages of directly owning 30 or more stocks instead of an index fund”

Comments are closed.