Below is an excerpt of my article “Why Gold Will Underperform For Another 40 Years Without Stagflation, Despite Central Bank, ETF, China And India Tailwinds“.

An 80-year History of Gold Performance

For the past 40+ years, gold has underperformed stocks, real estate, and even bonds on many metrics. For Americans, this 40-year period was preceded by another 40 years when it was illegal for US citizens to own gold, but fortunately for them, gold also underperformed in those four decades as well. When the Gold Reserve Act outlawed American ownership of gold 1934, gold was confiscated from individuals at $20.67/oz to be immediately revalued at $35/oz, where it remained until Nixon halted foreign conversions of the dollar to gold in 1971. Following this “Nixon shock,” gold quickly and steadily rose to $192/oz in late 1974 before declining back to around $100/oz in the late summer of 1976. If an investor had instead taken the $20.67 in 1934 and invested it in the Dow Jones Industrial average, this amount would have still grown to over $800 by late 1974, even after the 2-year ~40% bear market of 1972-1974. In percentage terms, the 40-year difference between the 1934 official rate and the 1974 high works out to an average gold appreciate (or dollar depreciation) of about 5.7% per year compared with an average total return of 9.4% for the Dow stocks.

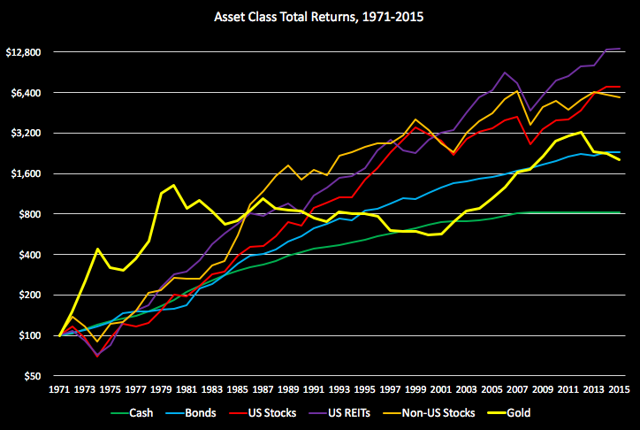

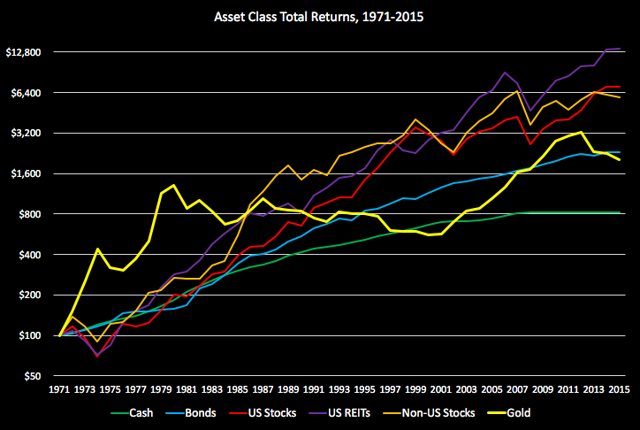

In the 40 years since, gold has appreciated from the $100-200/oz range in the mid 1970s to reach a high of almost $1,900/oz before falling back to the $1,000-1,500/oz range it has traded within for the past 3 years. During the same period, according to data from BullionVault.com whose name implies a bias towards making gold seem like a better investment), US real estate returned an average of 12% per year compared with 11.4% for stocks, 7.5% for bonds and 5.4% for gold. These lower returns for gold also came with far higher risk, with average annual swings in gold prices being 1.5x those of stocks and 2.5x those of bonds. In other words, gold has delivered lower returns with higher risk than these other major asset classes:

…

Unlike land, you cannot grow anything on gold, nor can you earn any income from tenants living on your gold. At best, gold could be lent out at interest like any other currency, but these rates are typically at or near zero for secured or AAA-rated borrowers (the best indicator was the “gold forward” or “GOFO” rate, which was a USD interest rate vs. gold collateral discontinued in January 2015, a chart of which can be viewed here.

A more promising trend is the issuance of gold-denominated bonds. The first I am aware of is the 5-year 0.5% bond issued by RandGold in South Africa, which could be purchased and redeemed in physical Krugerrands. On an even bigger scale, India recently finished issuing its fourth series of gold-denominated bonds with a sovereign guarantee, 8-year term, 2.75% interest rate in gold, and in this latest series, a capital gains tax exemption. In some ways, these gold-denominated bonds in India are similar to the inflation-indexed units of account used in Latin America (for example, the UDI in Mexico or the UF in Chile), which are basically inflation-indexed pesos which have historically had a real interest rate around +2%. Indians have traditionally entrusted a good share of their savings in gold, as will be discussed as a tailwind below.

…

Conclusion

Over the past 80 years, gold has been a relatively poor investment compared with stocks, bonds, or real estate, especially on a risk-adjusted basis. The increase in the price of gold over the past 10-15 years seems to have been largely driven by the three tailwinds of India/China demand, ETF allocation, and money printing by central banks, but even then this has not been enough to help gold catch up with the performance of the other “living, yielding asset classes.” Over the next 10-15 years, these tailwinds are likely to get even weaker as China and India see better alternatives to allocate savings to, ETF growth levels off, and central bank activities normalize.

What might change all this and lead a scenario where gold might be one of the best performing assets over the coming decades? In a word, what gold would need is stagflation – inflation rising to not just healthy but high levels, coinciding with year after year of decline in the real economy. Even in a stagflation scenario, the real estate assets often rise in value with inflation while also providing a positive real yield. In the short-term, gold can outperform real estate if several years’ worth of inflation fears are rapidly priced into it, which is why gold is a volatile asset that is dangerous to buy high. Long term, gold can outperform real estate only if the yield from lending out the former exceeds the real yield from harvesting or renting out the latter.

Tariq Dennison is a Hong Kong based CERTIFIED FINANCIAL PLANNERCM Professional and portfolio manager at GFM Asset Management LLC (www.gfmasset.com). GFM is a Hong Kong based asset manager and US registered investment adviser.