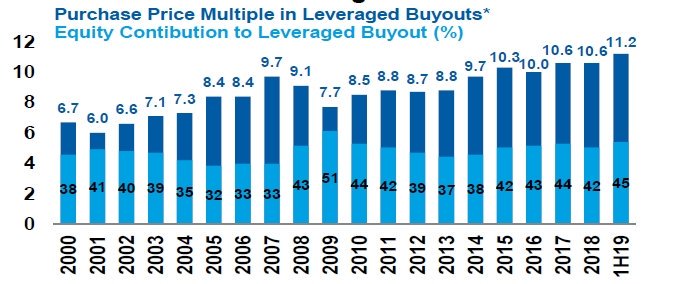

Thanks to this tweet from Meb Faber for sharing the below chart of multiples paid by private equity firms for leveraged buyouts (LBOs) since 2000 by “vintage year”.

When asked why I don’t believe private equity will generate returns anywhere near as high as pensions and endowments have seen over the past 30 years, these valuations are a large reason why. The more you pay, the lower the rate of return you get back from the same enterprise, hence the appeal of tilting investments towards value.