One of the most frequently asked questions I get is “what is the best way to transfer a large sum of money overseas, without getting ripped off by terrible exchange rates and high international transfer fees?”. Fortunately, we have started to see the rise of many financial technology (Fintech) firms like TransferWise and OnePip advertising international transfers for a fraction of what banks charge. For years, I have still found it better than TransferWise to transfer money between Hong Kong, the US, UK, Australia, Canada, Europe and Singapore by making local transfers on each end through my Interactive Brokers account and getting interbank level currency rates that save me thousands of dollars.

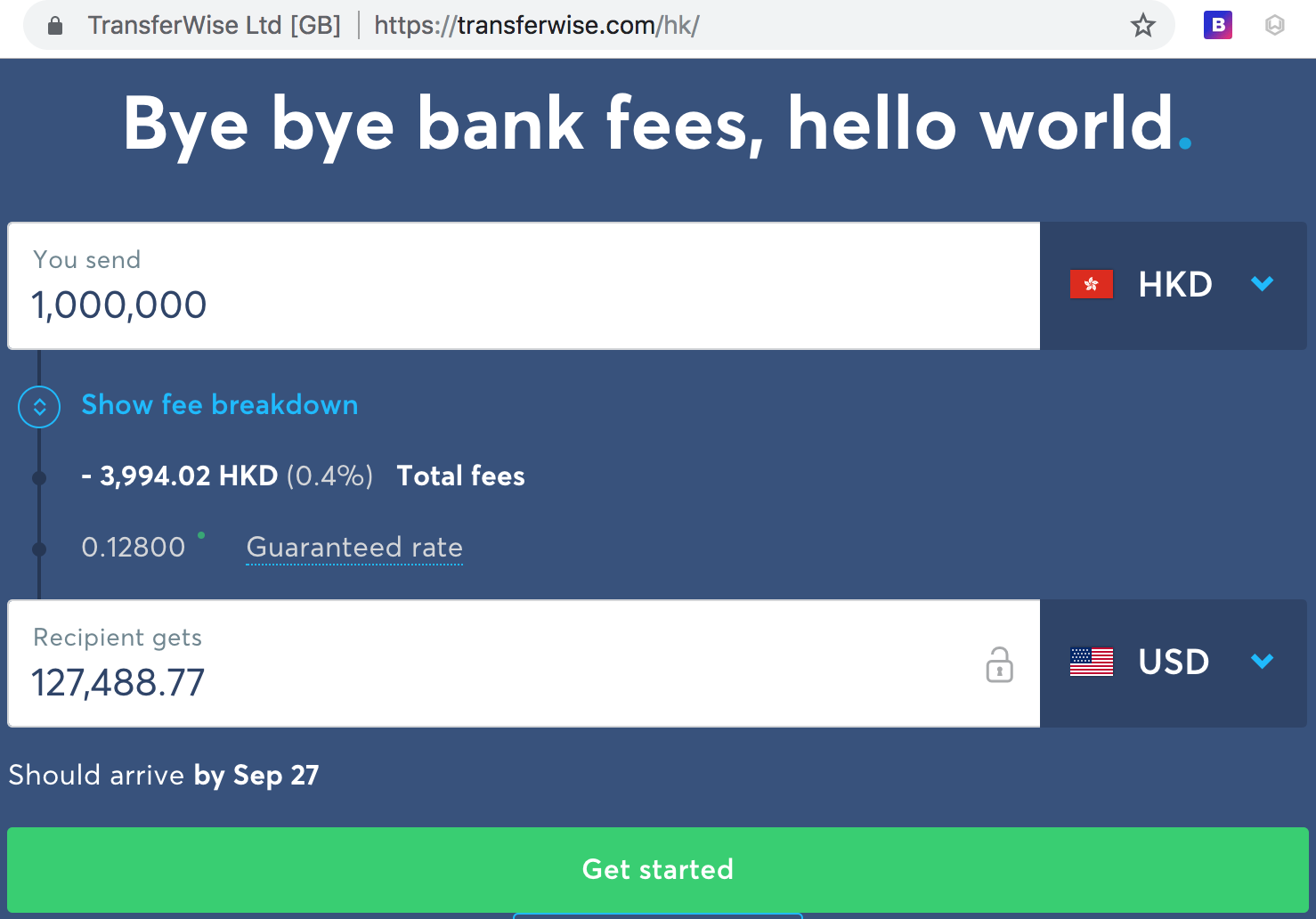

While many individuals may find transferring money this way more complicated than simply doing a wire transfer at a bank, I find the savings well worth the hassle whenever I’m transferring more than about US$5,000-10,000, where this method would save me around US$50-100 in fees versus a bank. As shown in the headline image, the breakeven amount vs Transferwise may be higher, as I show the example of transferring HK$1,000,000 from Hong Kong to the US, for which Transferwise charges about HK$4,000 (about US$500), while I would expect the same transfer would cost less than around US$25 through my IB account, assuming no extra bank fees on either side.

In order to transfer money internationally through Interactive Brokers, you would need the following three accounts, which importantly must all be in the same name:

- An Interactive Brokers account

- A local bank account in the source country, and

- A local bank account in the destination country

For example, if I want to transfer money from Hong Kong to the US, I would need a Hong Kong bank account and a US bank account, both in the same name as my IB account. The steps to do the transfer are:

- Log into your Interactive Brokers account submit a deposit notification to transfer money from your source account to Interactive Brokers. In most cases, you will then need to go to your bank to actually send the transfer to IB matching the notification.

- Within your IB account, convert the source currency into your destination currency (as described in this earlier post). If you are converting between two currencies other than US dollars or Euros (for example, from Hong Kong dollars to British pounds), you will often need to do two currency conversions, say from HKD into USD, then from USD into GBP, but both at interbank rates.

- Finally, submit a withdrawal request from your Interactive Brokers account to your destination account in your destination currency.

While the financial purist in me finds these steps far better than Transferwise in terms of overall cost, I admit there is room for improvement as far as user friendliness or being able to transfer to different name accounts. This is where I’d be curious to see how far Fintech solutions can go.

I am less often asked, but the same above steps can also be done through a Saxo account. Saxo’s FX rates are still more expensive than IB’s in my experience, though still better than Transferwise in terms of overall cost.

2 thoughts on “Better than Transferwise: Saving Thousands on International Transfers with an Interactive Brokers account”

As I know,it is not possible to open a bank account in a country without being resident,having an adress there.

How you solved this ?Normally people dont travel only to open a bank account there.

That’s not always true: having a local address can make it easier, but I’ve opened accounts in several countries with a foreign address and no local address.

Comments are closed.