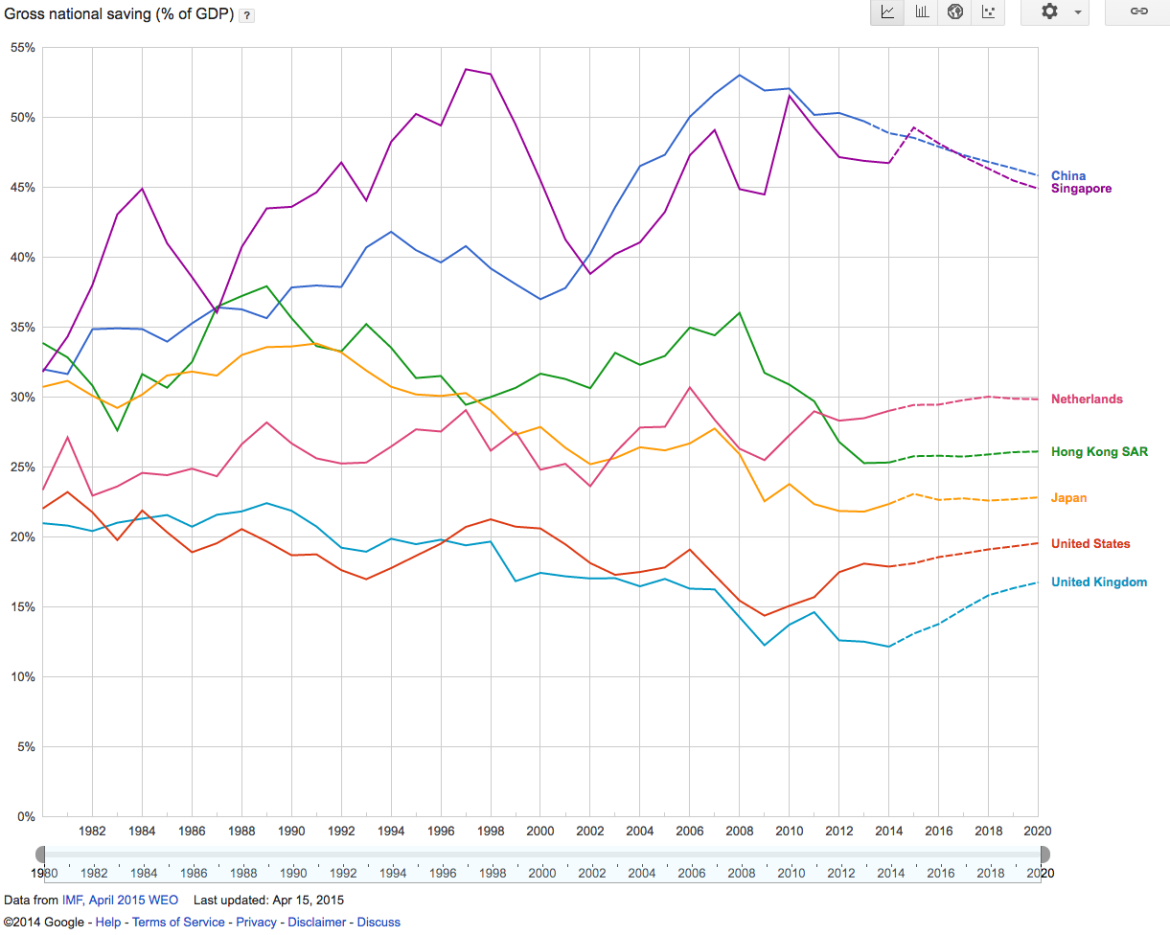

A widely said rule of thumb is that you should save 15% of your income towards retirement. According to the IMF, 15% is right around the average rate of total savings in the US and UK, and well within the averages of many Asian countries and other high savers like the Netherlands (Chart below from Google Public Data). But what are the assumed numbers behind why you should save 15% of your income towards retirement and not 5, 10, or 20%?

As a handy calculation, I chose a set of parameters which result in what I call the 15-40/7-4 rule. That may seem like a lot of numbers, but basically this means:

- Save 15% of your income each year

- For 40 years

- Average a 7% real rate of return before retirement, and

- Average a 4% real rate of return after retirement

The reason we use real rates in this calculation is to take out the factor of inflation, which we are also using to assume that your income only keeps pace with inflation over the 40 years and will only need to keep pace with inflation at retirement.

If you follow this formula, you will retire with a nest egg of about 30x your final annual salary, which will produce about 120% of your final annual salary as real passive income at 4%, or 90% of your final salary with a 3% real rate of return. Spending only the real return leaves the principal amount of your nest egg to continue growing at the rate of inflation for the rest of your life, which may lead to the good problem of having to worry about estate taxes.

These days, real rates of return above zero can not be guaranteed, but there are better and worse ways of targeting these rates of return in an investment portfolio.

Hopefully this post inspired you to think about why the 15% number gets tossed around, and what it assumes. Please use the contact form below to contact me if you have any questions about investing or making compound interest work for you.

Until next time,

Tariq