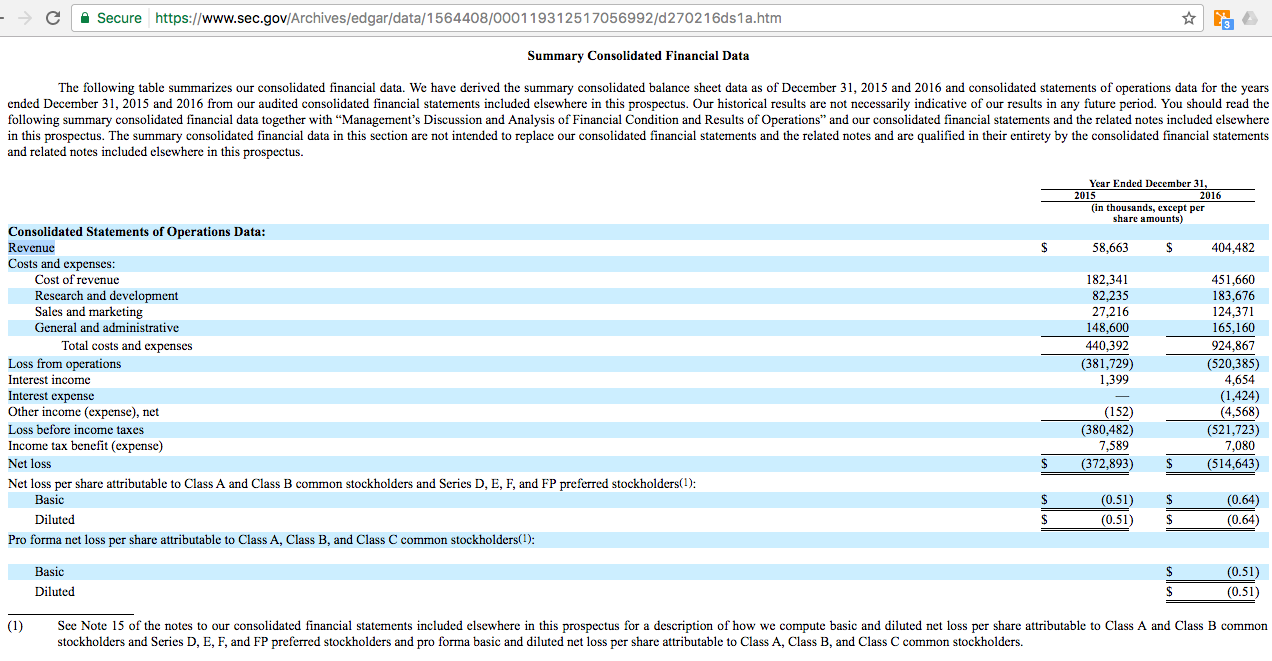

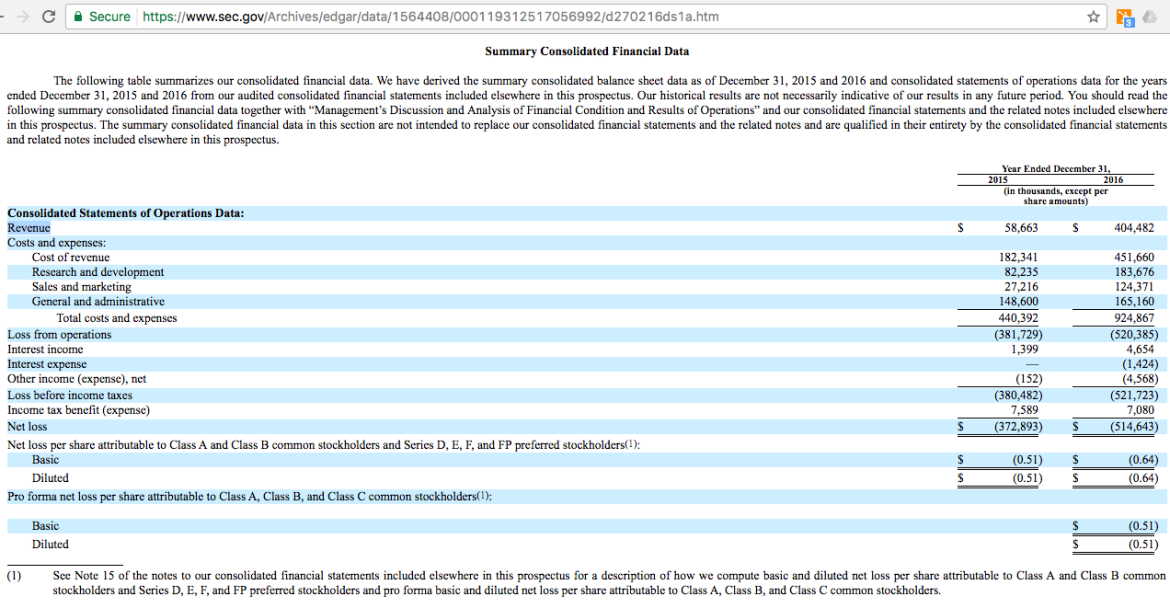

IPOs like Snapchat (formally Snap Inc, NYSE ticker: SNAP) are sexy, and I often say when investments are sexy, you are likely paying too much. That’s why instead of pretty pictures of Snapchat glasses, disappearing images of rainbow vomit, or even their logo, I made the featured image of this post Snapchat’s income statement reported on their share offering document. Here are 3 reasons we’re not buying the Snapchat IPO, are likely to not even look at buying SNAP shares this year:

- We are not a top fee-paying client of one of the underwriting investment banks, so were not going to benefit from the underpricing of the IPO in the primary market. This Forbes article explains this dirty practice in the case of Snapchat. While not paying millions of dollars to investment banks might cost us the occasional 40%+ pop on an IPO like this one, we are comfortable with the definite amount of money we save on fees and the better long-term returns that come from hard work rather than playing games like these.

- They’re not making money. As shown in their income statement below, Snapchat is still a speculative technology growth company, in the past two years showing greater losses rather than a trend toward profitability. We prefer to invest in companies that earn enough cash profits to return money to shareholders, while this company looks like one that may continue to take more money from investors before giving any back. I like to think long-term and understand the J-curve of investing in new businesses, but even the future profitability of Snapchat looks wildly speculative to me. For this to change, I would have to see a convincing reason why someone paying Snapchat money (so far mostly advertisers, not most of their “customers”) would choose them over someone like Facebook.

- The shares are non-voting. We are used to seeing many listed companies in Asia where fewer than 50% of shares are floating, and control remains in the hands of insiders, but it is unusual to see a $25 billion US IPO of non-voting shares, quite publicly closing corporate governance to investor control. While I might accept this level of minority shareholder power from a company like MTR Corp (0066.HK, which runs the rail public transit for Hong Kong and a few other cities, and understandably might not want an outside investor challenging the HK government’s controlling stake), I do not see the point of it for Snap. As this Reuters article points out: “If numbers are confusing, there are other reasons for investors to truly dislike Snap. The most important is the precedent it sets by offering stock that confers zero voting power. That is why calling them “shares” is an insult to, well, sharing. For now, they really should be considered rights to participate in Snap’s losses. The total control this IPO structure has conferred to Spiegel and his co-founder Bobby Murphy is totally without precedent on Wall Street.”

Until next time,

Tariq