This is part 4 in my 8-part guide to your financial life in Hong Kong. It is mostly intended for foreigners (especially US citizens or green card holders) living in or moving to Hong Kong looking to better understand “the system” and better manage their money both in and outside of Hong Kong. This one especially compares the Hong Kong and US specifics on retirement savings and may be most useful to American citizens or green card holders planning to retire or send their children to college back in the US. Let me know if you have any questions.

Hong Kong’s simple and efficient government is mirrored by a comparably simple system of retirement savings plans, most of which have relatively few investment options vs their US counterparts.

Although GFM is an investment management firm, and retirement and college savings planning are among our specialties, this article only contains general guidelines which may not be specifically appropriate to your situation. Please speak with us privately for personalized guidance.

MPF and ORSO – Hong Kong’s Two Main Defined Contribution Retirement Savings Plans

The two closest things Hong Kong has to the US’s 401k or IRA set-ups are the Mandatory Provident Fund (MPF) and the older Occupational Retirement Schemes Ordinance (ORSO). Generally, your employer will provide you with information on their MPF scheme, and may provide you options to contribute more than the minimum or may provide you the option to contribute to an ORSO instead of an MPF. As the name implies, the goal of the MPF ordinance is to mandate a minimum level of contributions to a defined contribution retirement plan, which has been HK$1,500/month by each the employer and employee for employees making at least HK$30,000/month since 1 June 2014. Your employer may provide you with the option of contributing more of your income and may offer to match some or all of your additional contributions, and we generally recommend clients contribute additional amounts only to take advantage of generous matching offers up to the matching limit and as far as the client is comfortable with the vesting schedule on the matched funds.

As in many 401k plans, MPF and ORSO plans are generally set up to be invested in the employee’s choice among a limited set of mutual funds selected by the plan offered by the employer. In our experience, many of the mutual funds in the plans we have seen tend to be relatively generic, opaque, and expensive, which is why we do not recommend extra contributions beyond the employer match whether or not the client chooses to invest any of these additional funds with us. Even then, we do believe it is important that employees allocate their MPF/ORSO contributions to a balance of diversified stock and bond funds, trying to choose low-cost index funds whenever possible.

What do I do about my 401k and IRA accounts back in the US?

In general (but not always), employees who move from the US to Hong Kong, whether on internal transfer or with an entirely new job, are considered to have been terminated from their US-based, W-2 issuing US employment arrangement. This usually means you will no longer be able to contribute to your old 401k plan, but should be free to rollover your 401k balance into either a new 401k plan or into a rollover IRA.

The good news for many Americans living and working in Hong Kong is that by not being covered by a US-qualified retirement plan at work, they may at least be able to make deductible contributions to an IRA, as described in this earlier post on expat IRAs.

Rolling over a 401k into an IRA is relatively straightforward, and we generally help clients do this as a direct rollover from their employers’ 401k plans to a GFM-managed IRA account. Rollover IRA accounts have the advantage of far greater choice and flexibility in investment options, usually with greater fee transparency, and of course, not having to go through a previous employer to access your own retirement account.

Can Americans continue contributing to an IRA, 401k, or other tax-deferred plans while living abroad?

US citizens and green card holders who qualify can generally continue contributing to IRA accounts, subject to limits and deduction conditions which can be seen on the IRS website: https://www.irs.gov/retirement-plans/ira-deduction-limits

Unfortunately, 401k plans are set up by employers, and unless your employer agrees to set up a US payroll and run a 401k plan for you back in the US, this generally is not an option for expats. If your employer is motivated, we can help set up 401k plans for employers of Americans overseas.

There are other tax-deferred plans which may be worth considering depending on details of your situation.

What about saving for college back in the US?

As with IRAs, US citizens and green card holders living abroad can continue contributing to 529 college savings plans or Coverdell Education Savings Accounts (ESAs). 529 plans have the advantage of having far higher contribution limits, enabling you to contribute up to US$70,000 up-front while spreading out the gift tax exemption over 5 years and allowing more time for your investment returns to compound tax free. One possible disadvantage of 529 plans is that they are run by states that generally do not provide the same flexibility, choice, and transparency in investment options as you might find in an IRA account.

One of the more unique 529 plans I have been using for almost a decade now is the Private College 529 (https://www.privatecollege529.com/OFI529/), which instead of mutual funds allows you to lock-in future tuition at today’s prices at your choice of almost 300 private colleges and universities across the US. This 529 plan acts like a pre-paid tuition plan, but giving you the flexibility to choose which of these schools you or your child will attend later. We help interested clients open a Private College 529 plan as a courtesy, and receive no fees or commissions for doing so.

Investing for Retirement and College

Contribute to tax-advantage retirement and college savings account can provide substantial savings in the long run, as well as providing the discipline to automate savings of a certain amount of money every year, but by far the biggest factor driving how much money these accounts add up to when they’re needed is how well they are invested. The more common mistake I see is younger savers investing these accounts too conservatively, even in cash, and not allow them to earn higher compounded returns over time. There is the other extreme mistake of taking too much risk and losing a large percentage of one’s college or retirement savings in a 2008-style crash, but of course both should be a clue that a balanced approach generally provides the best long-term results. One set of numbers I keep in mind on the power of compounding : $1,000/month saved for 30 years and invested at 8% per year will grow to about $1,500,000, of which only about $372,000 were monthly contributions and over $1 million coming from investment returns.

Until next time,

Tariq

+852 9476 2868

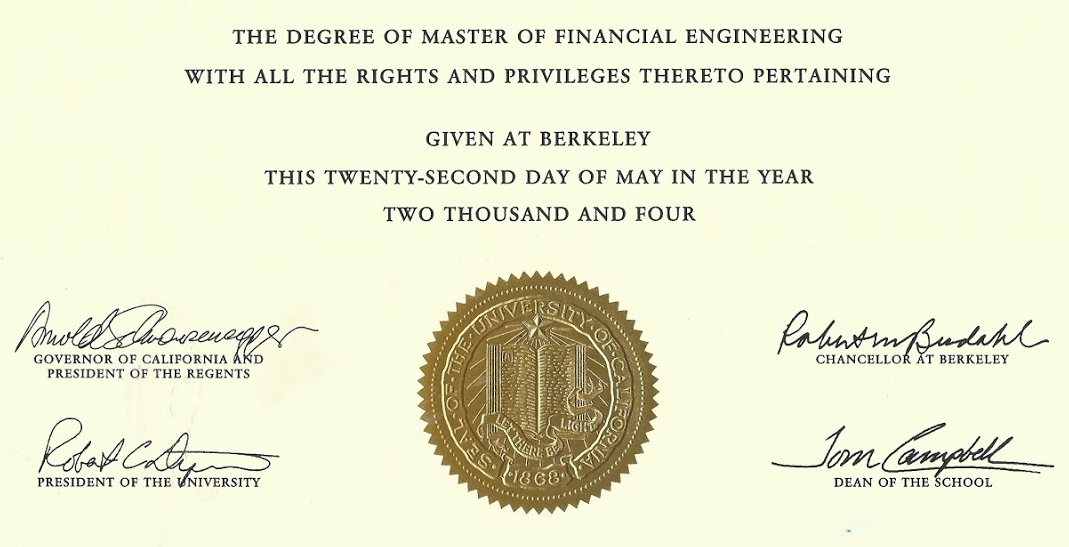

P.S. Yes, the image is actually part of my own Master’s degree diploma from UC Berkeley signed by then-Governor Arnold Schwarzenegger

One thought on “Your Financial Life in Hong Kong, Part 4: Saving for Retirement and US College Education from Abroad”

Comments are closed.