One of the most memorable lines I heard from my professors back at UC Berkeley was “what I am about to teach you here should work almost anywhere in the world, except Japan”. This was over a decade and a half ago, when many portfolios still needed to define whether they were “ex-Japan” and “ex-China” was not even a question. Meanwhile, one of the most staple concepts in constructing investment portfolios is that of “60/40”, a model for allocating 60% to stocks and 40% to bonds to balance risk and return. Inspired by a tweet asking whether 60/40 might be outdated, I thought it would be worth running a quick test to see how well it might have worked in a market famous for a stock average still trading about 40% below its highs roughly 30 years ago. Short answer, yes, 60/40 has worked well, even in Japan.

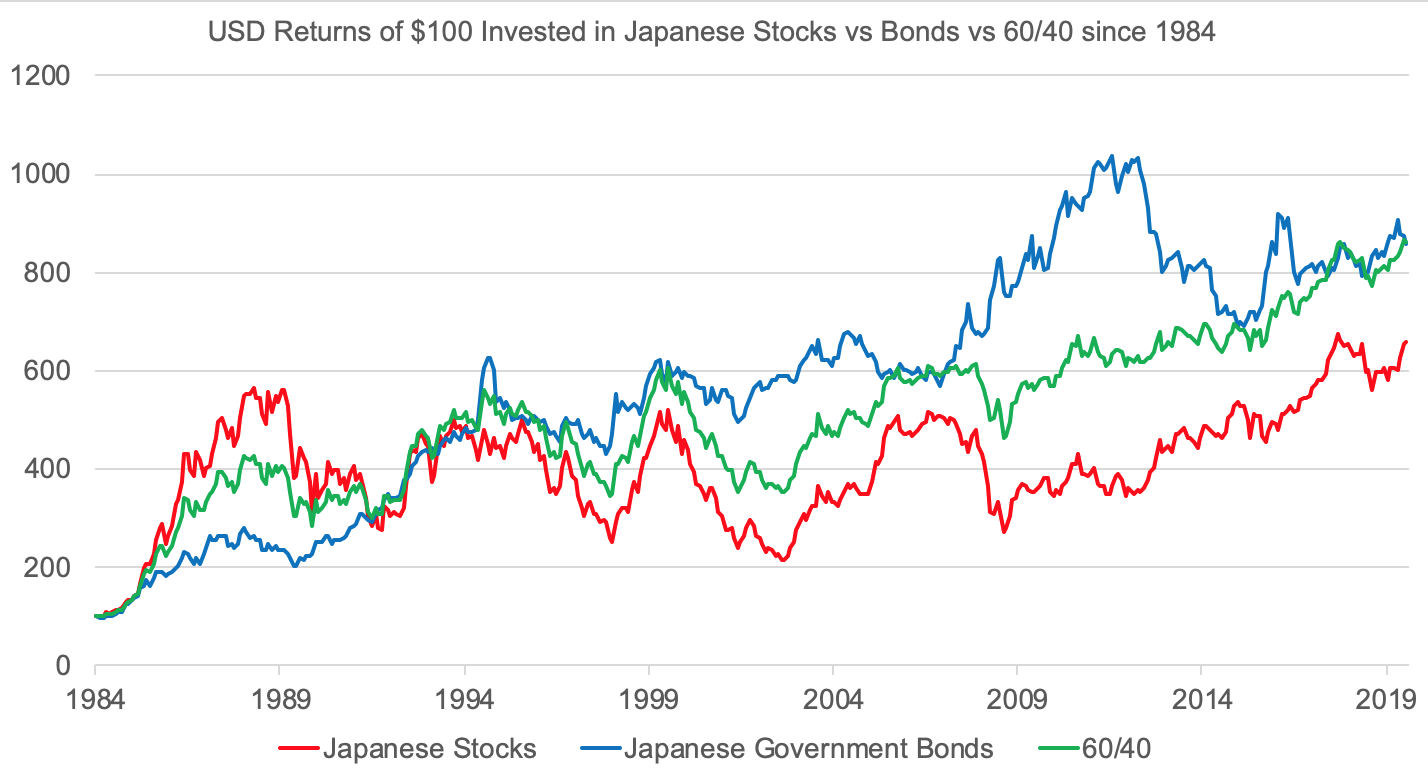

Below is a quick and dirty chart of how $100 invested by a USD-based investor would have grown since 1984 invested in a.) 100% Japanese stocks, b.) 100% Japanese government bonds, or c.) a 60/40 mix between Japanese stocks and bonds, rebalanced monthly. My data sources on this are a bit of a hodge podge and may not be perfect, but I believe this should capture net of withholding tax, USD based investor returns well enough.

Short summary: Japanese stocks did great in the late 1980s bubble, but are barely above even since then, even with dividends reinvested through all the ups and downs. Japanese bonds have done much better through the 1990s and 2000s, but have experienced far more volatility since 2013. The monthly rebalanced 60/40 portfolio over this period did as well as the better performer with only slightly more volatility than bonds.