The US Federal reserve has been raising interest rates slowly but steadily over the past 18 months so far, but many banks have been far slower to start paying these higher rates on to customer deposits. HSBC Hong Kong, as shown in the recent screenshot below, still pays 0.25% on savings accounts and 0.5% or below on most US dollar time deposits.

Bank deposits vs US Treasury bonds, notes and bills

By comparison, you could earn over 1.8% on short term treasury bills, and we’ll over 2.5% on longer term notes. These notes and bills are issued by the US government in $1,000 denominations, and are some of the most liquid financially instruments in the world: http://www.wsj.com/mdc/public/page/2_3020-treasury.html

This 1.5% difference means many depositors are forgoing at least $1,500/year for every $100,000 kept in the bank rather than in a higher yielding bond or time deposit product.

Source: hsbc.com.hk

What about high rate time deposits at banks?

While bank deposits are sticky, there still is competition between banks to get customers to move deposits to them. Understandably, many banks would rather you keep your money in their deposits, or at least pay them a few to buy a bond from them, so at best may compete by offering bank deposits yielding at it sightly above what a government bond will pay you.

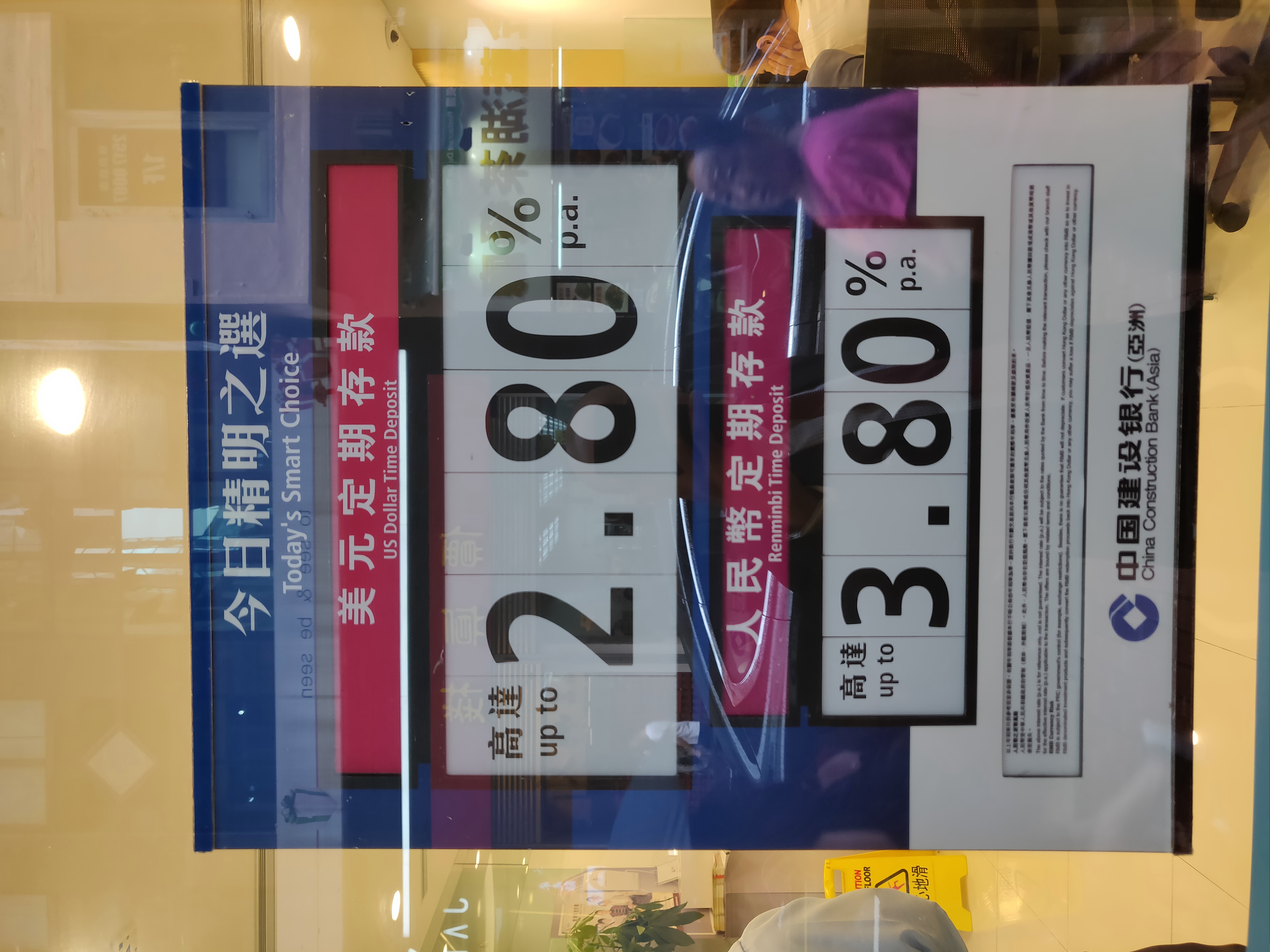

The headline photo is from China Construction bank, and the below from Standard Chartered bank, both trying to attract deposits to their higher yowling, longer term products.

What about bond ETFs?

To get most of the yield and market exposure of bonds, including bonds issued by higher yielding companies and foreign issuers, with the ease of trading stocks, I often look at keeping substantial positions in bond ETFs (or sometimes bond futures). Many of the bond ETFs I look at are now yielding between 3.5% and 5.5%, a yield pushed up by the fact that these ETFs have fallen in value as rates have risen this year.

As always, I look forward to hearing from you if you have any questions about bonds, ETFs, or how to earn higher rates on your savings.

5 thoughts on “Earning less than 2.5% on cash? Higher rates from bank deposits and bond ETFs”

Nice 🙂

Those interest rates on the time deposits are for attracting new deposits and do not last for ever.

What would you advise a 20 year old looking to invest his internship stipend..China Tower IPO?

Best investment for a 20 year old intern would be in a copy of my book 🙂 Invest Outside the Box

Comments are closed.