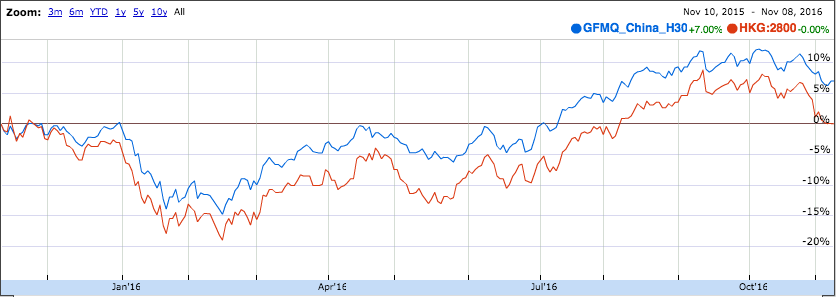

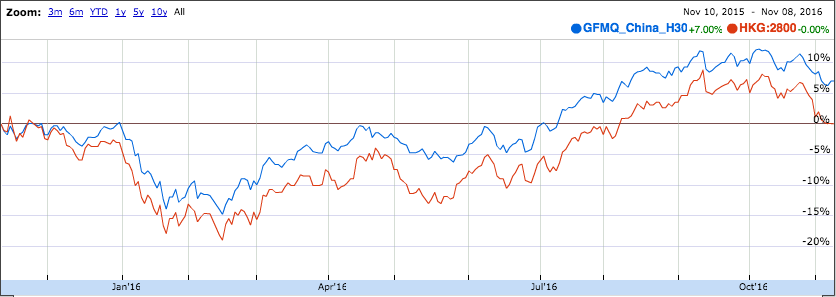

In Hong Kong, we aim to outperform the Hang Seng index through a proprietary selection of stocks we believe are higher quality and/or better valued than the market-cap weighting of the 50 stocks of the index, and in most cases in Hong Kong we also try and avoid low-float companies. For the 12 months ending November 8th, 2016, our roughly equal-weighted portfolio of 30 round lots of our select Hong Kong companies outperformed the Hang Seng index tracker fund (2800.HK) by about 7.0% with comparable volatility.

In client portfolios, we can usually replace positions of2800.HK or EWH with round lots of this select “GFM Hong Kong 30” or “GFM H30” portfolio in multiples of around HK$500k / US$65k. Past performance is no indication of future results.