Not surprisingly, when in Hong Kong I hear a lot about USD/CNY and HKD/CNY, and when in India I hear most interest in USD/INR, but for some reason I hear very little about the exchange rate between these two most populous countries. I just happened to be in India for the second half of the month when the rupee had a record free-fall, having reached 66 to the dollar just after its 66th anniversary of independence (not exactly a devaluation of Rs. 1/year), and then to read Derek O’Brien (MP, Trinamool Congress) announce the race to ₹100 is now between the dollar, one liter of fuel, and 1kg of onions .

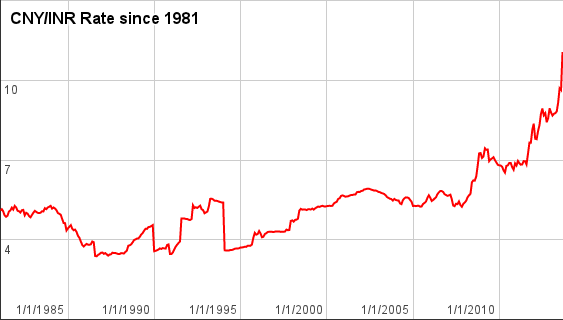

Somehow I have seen almost nothing about the CNY/INR cross rate passing 10 for the first time earlier this month, or even more shockingly how it just crossed 11 before the month finished, after decades in a relatively stable range of 4-6 (then 6-8 between the crisis and last year):

In short, both the yuan and the rupee depreciated together (along with many EM currencies) during the 80s, found a bit more stability in the 90s and early 2000s, then appreciated together during the 2004-2008 EM boom, and only diverged after the crisis.

China has artificially held its currency down far lower, far longer than India has, and has been managing a very slow appreciation for the past few years. It has learned, like Japan, it is easier to keep your currency from appreciating than depreciating, and in doing so, the central bank buys large quantities of dollars at a high price in local currency terms, but they can print their own currency. For now, inflation has been more the bane of India’s currency, but prices have also been rising in China faster, many would agree, than officially reported rates. My own view on the RMB remains the same as before: the RMB’s post-2005 appreciation is a slow race with inflation, where domestic inflation will eventually make the currency fairly valued – at what level is still to be debated.

I am still looking up more about the FDI and trade statistics between India and China, but the best I have seen so far is this graphic from the Guardian:

3 thoughts on “CNY/INR breaks 10, then 11 in the one month of Aug 2013 alone”

Also I wonder if there are profitable examples from other economies post dramatic decline. Real estate buying perhaps…?

I would love to get more data on it, but generally have found that any asset whose real cash flows can be increased to offset (or surpass) the effects of a currency devaluation do well – real estate and many equities. I remember when the ISK crashed by half, prices of many things there roughly doubled so that their dollar prices were roughly unchanged.

Might be worthwhile buying sine IT outsourcing firms that may be the lucky beneficiaries of the INR decline…

Comments are closed.