The Fee-Only Difference

One of the most important questions to ask any financial professional is “how do you get paid?”. As a fully transparent, fee-only advisor, we take no commissions on any products our clients invest in. This is very important in removing any incentive to push products.

Rather than charging any up front commission, a fee-only advisor makes money by either charging:

a.) an asset-based fee charged as a percentage of assets under management, or

b.) a performance-based fee charges as a percentage of profits on accounts manager, or

c.) an hourly fee invoiced on a per-service, per-project, or monthly / annual retainer basis.

Our fixed management fees start at 1.5% per year of assets under our management, and are reduced as the account gets larger or stays with us longer. Alternately, clients may instead choose to pay a performance fee of 25% of the total return on their account above the previous high water mark (explained here) with no fixed fee. We also manage accounts with a negotiated combination of these two fee structures.

We aim to ensure our fees remain proportionate to the benefits our services provide, and have considered innovative fee structures like the Kitces-suggested income-based model.

To keep total costs low, we see it as an important part of our job to minimise costs and maximise the value of any externally managed investment products we use, such as ETFs. In many cases though, we are able to make direct investments and avoid this additional cost.

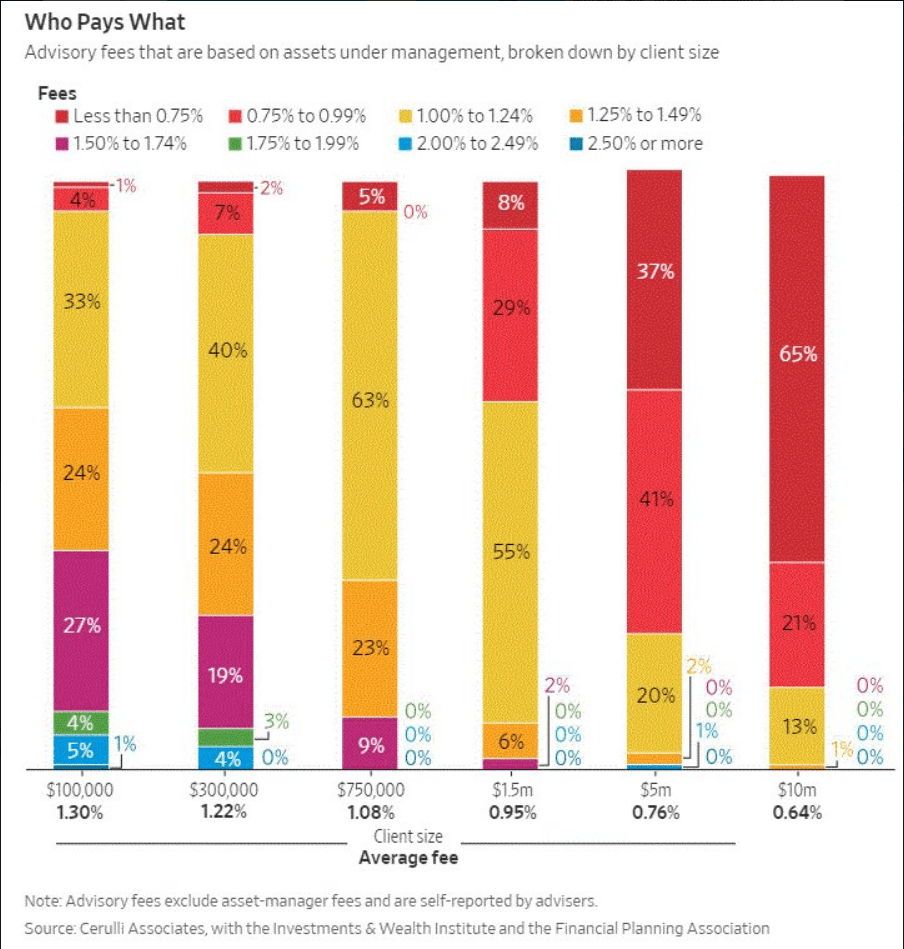

For comparison, below is a chart posted in the WSJ journal showing what financial advisors charge on accounts of different sizes, not including investment product fees:

Source: https://www.wsj.com/articles/the-price-of-financial-advice-is-finally-falling-1538965020

Michael Kitces has also published a study on how much a comprehensive financial plan should cost.

Brokerage execution and custody fees (if any) are extra and charged separately by the broker, but we choose to work with firms like Interactive Brokers, Saxo and Vanguard to keep these fees at a minimum.