I have been working with “smart beta” strategies since 2006 (before they were even called “smart beta”), and continue to believe that investing through these rules-based factors provides better risk-adjusted returns than index funds at far lower cost than actively managed mutual funds. In GFM-managed client accounts, we continue to apply the well-researched factors, of quality, value, and low beta/volatility (in that order), when constructing direct stock portfolios, and continue to believe these direct portfolios are better for many investors than index funds or ETFs, especially in Asia where markets are less efficient than in the US.

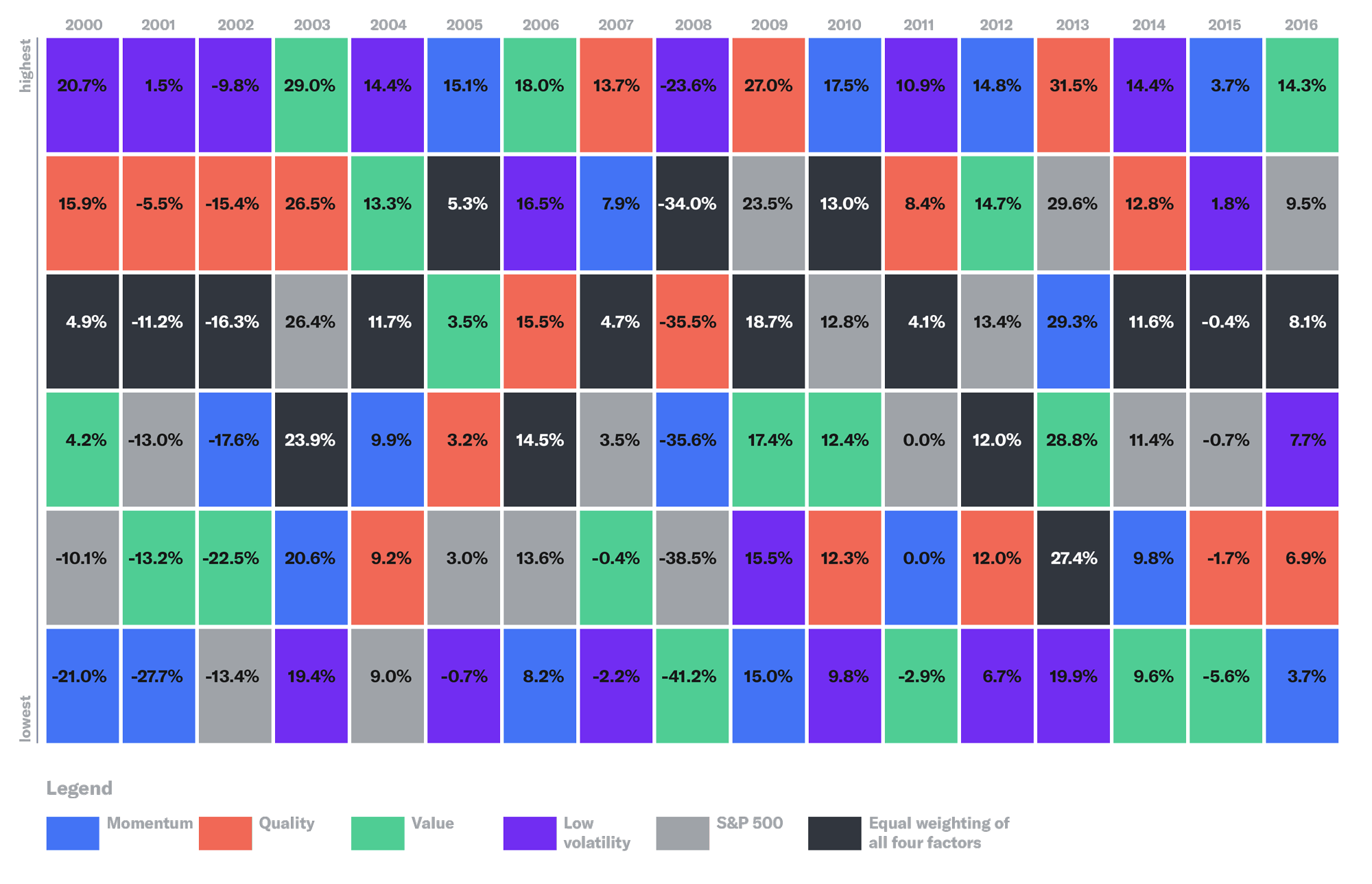

I was pleased to see a chart by US-based robo-advisor Betterment (even though you might consider Betterment a GFM competitor) showing how the four main factors in Goldman Sachs’s smart beta ETFs have performed year-by-year from 2000 to 2016. These factors were applied to the US market, but we were pleased to see that our favored factors (quality first, value second, while keeping an eye on risk/volatility) alternately but consistently outperformed the S&P 500 most years, with low volatility typically doing best in down markets.

This would imply that investors or fund managers believing the market to be overvalued and due for a correction should consider going long low volatility/beta stocks and short high volatility/beta stocks. Here I use volatility and beta interchangeably, as low beta has also been shown as an outperformance factor, but I’ll save the low volatility vs low beta debate for another article.

Source: Betterment

Until next time,

Tariq