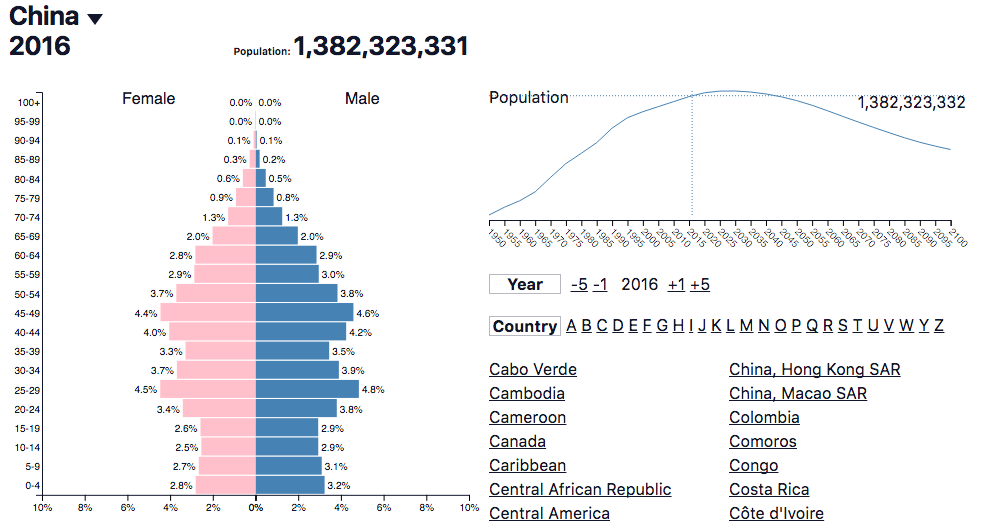

On several occasions, I’ve discussed the somewhat intuitive relationship between population pyramids and interest rates / yield curves. One one end, bottom-heavy, triangular population pyramids would tend to drive higher interest rates, as the abundance of young people pushes overall economic growth and demand for credit, as we have seen in countries like India and Indonesia. On the other extreme we see rectangular or top-heavy population pyramids paired with low interest rates and economic growth, as the greater number of elderly retirees floods the market with savings (the supply of credit), while fewer younger workers limits the demand for credit, as seen in Japan and Western Europe with their negative interest rates.

Last week on RTHK Radio 3 “Money Talk”, we discussed how automation, technology, and robotics might break this pre-21st century demographic-economic relationship by adding a third gender to population pyramids for female, male, and robot workers. Robots would increase productivity, but what would they do for the supply/demand for money and credit?

Until next time,

Tariq