One situation I’m glad to be able to frequently help with, which can often save thousands of dollars, is how to covert relatively large amounts of money from Hong Kong or Singapore back home. If the money doesn’t need to be moved over as quickly as a relatively expensive wire transfer or remittance service might do, I help clients get institutional currency conversion rates through Interactive Brokers accounts. Transfers are done as local bank transfers on each end, which can also reduce or save wire costs.

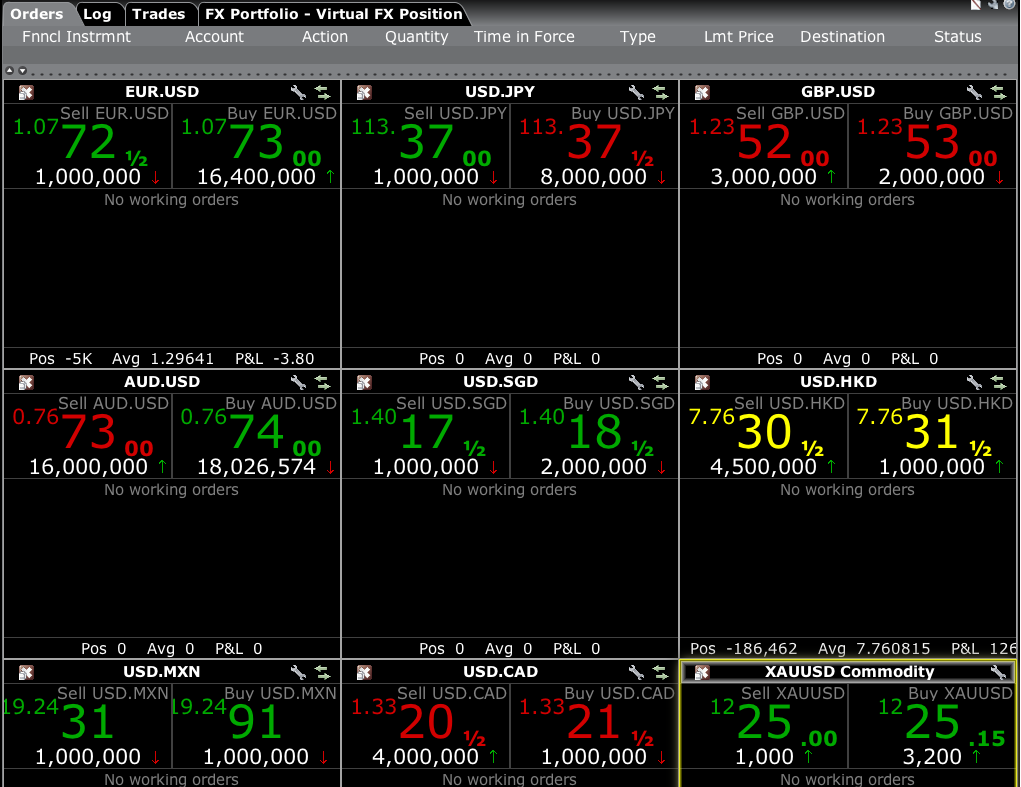

As you can see in the sample trading screen below, the institutional currency exchange rates are often only about 0.01% wide from the price you buy or sell a currency, compared with banks that can charge individual customers 1% or more. On a $100,000 transfer, 1% is a $1,000 difference.

I mostly see these transfers like these being done from Hong Kong or Singapore to the US, UK, or continental Europe, but this method should cover Canada and Australia as well:

1. Open an Interactive Brokers (IBKR) account. You can either do this directly online through their website, or we can help you open one under GFM management, which you can ask us about through the contact form below.

2. Once the account is opened, you can fund the account through a simple local bank transfer (or in Hong Kong, a cheque over HK$80,000) to Interactive Brokers’s local Citibank NA account.

3. Once your IBKR account is funded, you can then do the currency conversion at institutional rates. Here’s an example of my IBKR currency trading screens this morning – note the bid-offer spread is less than 0.01% wide, and the commission is only US$2 for this trade (you can also set limit orders if you want to wait for a better rate, or we can help you execute the conversion):

As one recent example of converting US$100,000 into Singapore dollars, here was the conversion rate and Interactive Brokers’s US$2 commission:

4. Once your IBKR balance is in your desired currency (US dollars, British pounds, Canadian dollars, Euros etc.) you can then withdraw it to your same name home bank account, also as a local transfer (e.g. ACH in the US).

Of course, our business is managing investment accounts on Interactive Brokers, not so much just doing cash transfers from one country to another, but this is something we are happy to help with as part of our mission to make global finance simpler and more cost effective. We know once you work with us, you will see us as the clearly best advisor to help you get the most out of global financial markets.

Do get in touch through the contact form below if we can help you will currencies or global investing.

Until next time,

Tariq

+852 9476 2868

One thought on “How to best convert and transfer large amounts of money across currencies at low cost”

Comments are closed.