Financial websites contain scores of “retirement calculators” which allow you to input a variety of assumptions and calculate when you may be able to live off your savings without working again, depending on how much you save, how much income you need in retirement, and of course what the rate of return on your investments is. These vary widely in complexity, ease of use, and visual appeal, but three I might point out include those of Vanguard, CNN, and even US self-regulatory body FINRA.

Yesterday I saw a fascinating retirement calculation published in the op-ed section of the print edition of the Straits Times, which unfortunately I could not find an online version of, but I felt worth sharing because it simplified the retirement calculation down to two variables:

- Your savings rate, and

- Your rate of return on your investments

The two corresponding big assumptions that allow the calculation to be simplified so much are: 1.) Your spending needs will continue to equal what you make minus what you save even after retirement, and 2.) Your rate of return will remain constant, even after retirement. Both assumptions may be a bit a of stretch, but might offset each other if you assume (as many retirement calculators do) that both your spending needs and rate of return will be lower in retirement.

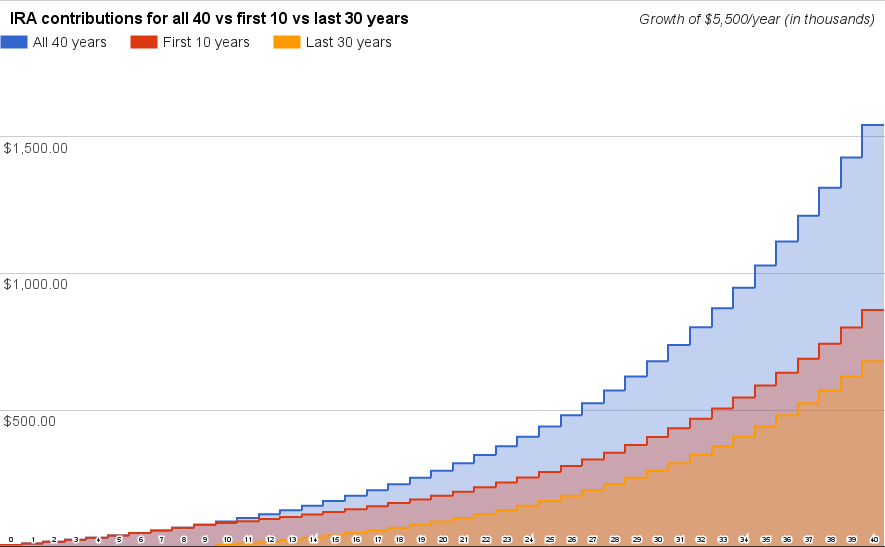

To keep round numbers, we will assume your income is $100,000 per year and that you save either A.) 10% or B.) 20% of your income, and earn either 1.) 5% per year on your investments, or 2.) 10% per year on your investments. You can adjust for inflation by treating the dollar amounts as “real dollars” and the rates of return as real rates of return if you like.

The back-of-the-envelope results of these calculations are:

A1.) Saving 10% and investing it at 5% per year will take 47 years for your investment income to replace your pre-retirement income,

B1.) Saving 20% and investing it at 5% per year will take 32 years for your investment income to replace your pre-retirement income,

A2.) Saving 10% and investing it at 10% per year will take 23 years for your investment income to replace your pre-retirement income,

B2.) Saving 20% and investing it at 10% per year will take 16 years for your investment income to replace your pre-retirement income,

So this quick calculates that to retire early, it helps to double your savings rate, but it is almost twice as important to double your rate of investment returns and find a way to sustain it over the long term. Of course, with these numbers, I do not recommend anyone try and rely on 10% long-term returns, although there are ways to get close and control your risks depending on what your situation and plans are.

We welcome your questions about retirement calculations and how to improve your long-term investment returns. Please feel free to contact us through the form below: