“Save early, save often” can sound so much like a cliche that it fails to motivate us, but it us hard to underestimate how powerful it can be to set up an automated savings plan early and ensure that it is invested appropriately.

Many numbers and calculations get thrown around, but given it’s April and the US IRA contribution deadline is approaching, I thought I’d use IRA numbers for this example. As of 2016, the IRS allows many individuals to make annual IRA contributions of $5,500 (US$6,500 for those 50 and older), which has been increased over time, but for this example, I will assume we are starting with a 25 year old making the same US$5,500 per year despite likely being allowed to contribute more in the future.

Some statistics on the importance of investment returns:

- 40 years x $5,500/year = $220,000. Keeping one’s IRA in cash may grow this to a bit more over time if interest rates rise, but not likely much more.

- With investment returns averaging 4% per year, this account will grow to about $550,000 at the end of 40 years.

- Returns averaging 8% will grow this account to $1,540,000, and

- If the investor can average 12% per year, the account will grow to $4,730,000

So clearly the rate of return earned makes a huge difference over the long run, and we generally see savers making the mistake of investing too conservatively rather than too aggressively in their IRAs, although the latter can of course be as bad if not worse.

Another statistic which will hopefully motivate younger savers to start saving now rather than wait:

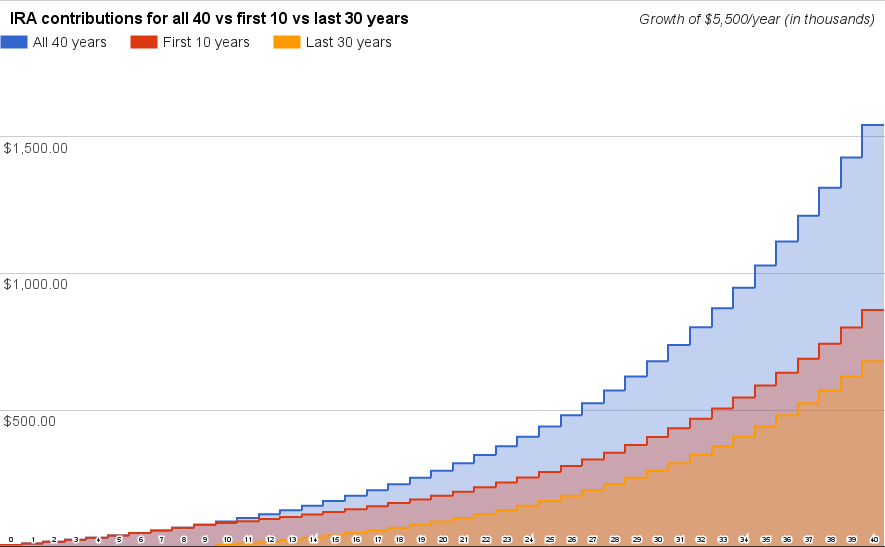

- As mentioned above, 40 years of contributions earning 8% would grow to $1,540,000

- If you only made contributions for the first 10 years (so only $55,000), you would have put away only 1/4 as much, but ended up with over half the eventual balance: about $865,000

- By contrast, if you waited the first 10 years and only made contributions for the last 30 years, you would have put away $165,000 but only grown this to $678,000.

So while consistency is good, getting started earlier provides a headstart that can be difficult and expensive to catch up to later. As a chart, the above three plans are plotted below:

Hopefully this motivates you to think of these calculations not just as academic numbers that get tossed around, but powerful reminders on the huge difference regular saving and assertive investing can make to your long term liquid wealth.

To encourage IRA savers to work with us on boosting their investment returns, we lower our standard account minimums to the IRS limits to clients who set up regular contributions. You can send us a message through the form below or contact us if you have any questions on setting up a managed IRA.